Virginia Economic Outlook Index Flat Versus Q2; Ninety-Eight Percent of CEOs Prefer the Fed to Hold or Reduce Interest Rates; Sixty-four percent Have Concerns About Inflation and Revenue

CEOs Again Expect Revenue and Employment to Increase Over Next 6 Months with Capital Spending Remaining Flat

Ninety-eight percent of small business CEOs indicate that they prefer that the Fed either reduce interest rates or hold them at the current rate with only 2% preferring that rates increase further. Sixty-four percent of respondents view inflation and revenue concerns as the biggest challenges facing their business in the near term versus 74% in a national survey by the U.S. Chamber of Commerce. That’s the latest from the quarterly CEO Economic Outlook Survey conducted by the University of Richmond’s Robins School of Business and the Virginia Council of CEOs.

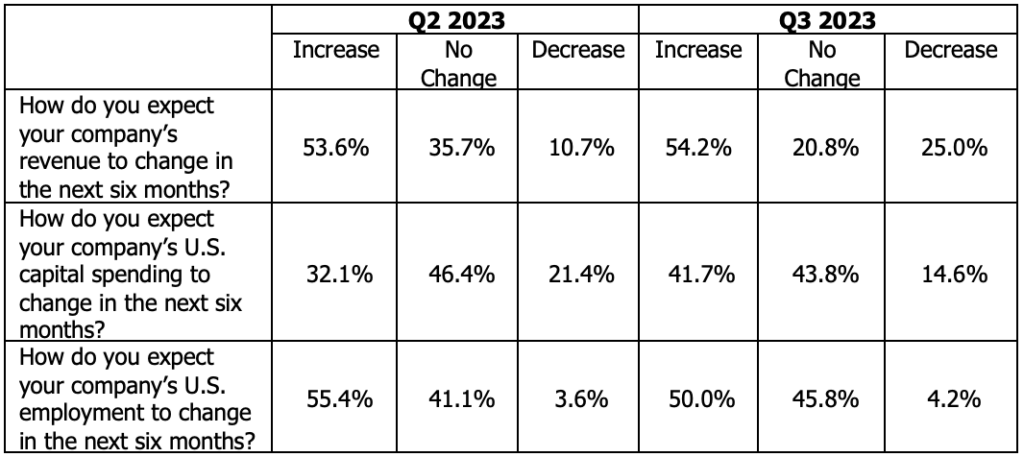

Fifty-four percent of CEOs expect revenue to increase, with 23% expecting at least a 10% increase, while 50% expect employment to increase over the next six months.

The survey found expectations over the next six months for revenue and employment were both positive with capital spending to grow slightly faster than expectations a quarter ago.

More than half (54%) of CEOs indicated that they expect revenue to increase over the next six months.

- 4% expected revenue to be “significantly higher.”

- 50% expected revenue to be “higher.”

- 25% expected revenue to be “lower.”

- 21% indicated they expected no change.

Forty-two percent of CEOs expect capital spending to increase over the next six months (up slightly from 32% last quarter), while 15% expect capital spending to decrease. Forty-four percent expect capital spending to remain flat.

Fifty percent of respondent CEOs expect employment to increase over the next six months. Additionally, 46% expect employment to remain flat while only 4% expect employment to fall.

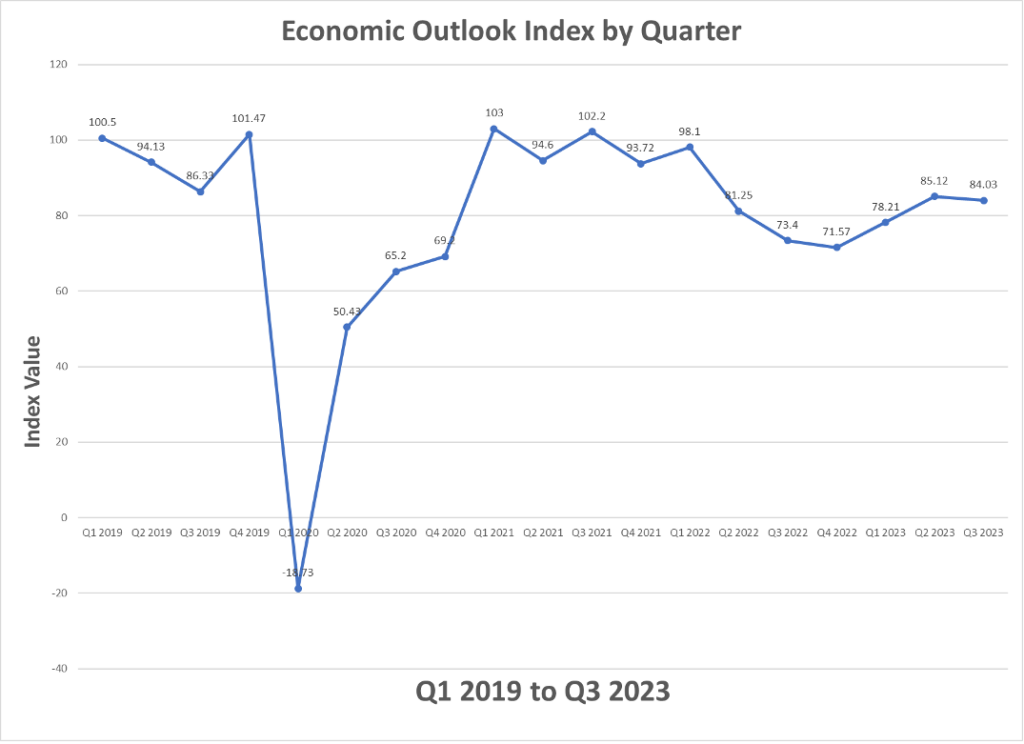

Taken as a whole, the results pertaining to revenue, capital spending, and employment expectations are down very slightly from last quarter with the overall Economic Outlook Index decreasing (84.0 versus 85.1) relative to the results from the end of Q2 2023.

Additionally, CEOs were asked their preference with regard to further interest rate changes by the Fed. They reported that they preferred the following:

- Further raise rates: 2%

- Reduce rates: 44%

- Leave rates as they are: 54%

They were also asked to rank order the challenges facing their businesses in the near term. They reported the following as the most challenging:

- Inflation: 32%

- Revenue Concerns: 32%

- Interest Rates: 23%

- Supply Chain Issues: 13%

“The survey results suggest that CEOs have positive revenue growth expectations but see inflation as an ongoing item of concern. They also strongly prefer that the Fed avoid further interest rate hikes” said Rich Boulger, associate dean at the Robins School, who administers the survey and collects the responses. “The overall index is approximately flat (84.0 versus 85.1 at the end of Q2 2023) and up from 73.4 of a year ago.”

“The sentiment from CEOs I am talking with lately is far more pessimistic than this data. The storm clouds they are seeing must be beyond the survey’s six-month outlook!” said Scot McRoberts, executive director of VACEOs.

The Robins School and VACEOs jointly conduct the quarterly survey, which regularly asks about expectations for revenue, capital spending, and employment, plus other relevant issues, helping Virginia companies anticipate business conditions and plan for growth. The Robins School adapted the survey from the Business Roundtable, an association of CEOs of American companies that conducts a similar survey nationally. Rich Boulger, associate dean at the Robins School, administers the survey and collects the responses. The quarterly survey has been administered since 2010.

Forty-eight CEOs responded to the survey, which was administered October 4 – 10. Multiple industries are represented in the sample although services and construction represented the majority of the respondents. The average company whose CEO responded to this survey had approximately $10 million in revenue for the most recent 12-month period. The average employment was 45.

The Council continues to expand the survey beyond its members, offering any area business owners whose companies gross at least $1 million in annual revenue the opportunity to participate. If enough businesses participate, the Council will provide survey results by industry. Participation is free, and all participants will receive copies of the survey data.

Business owners and CEOs who would like to participate in the next survey should contact Scot McRoberts at smcroberts@vaceos.org.

Virginia Council of CEOs (VACEOs) is a nonprofit organization connecting CEOs for learning and growth. Formed more than 20 years ago, member benefits include placement in a peer roundtable group and access to a thought leader network, and a robust program of events for learning and growth. This is not a networking group, but rather a group of CEO peers who are invested in the success of each Member. To qualify for membership CEOs must run a business with $1M+ revenue and 5+FTEs. Learn more at www.vaceos.org.

The Robins School of Business is the only fully-accredited, highly-ranked undergraduate business school that also is part of a highly-ranked liberal arts university. The Robins School is also home to the Richmond MBA. The school’s executive education division offers customized training and consulting to a wide variety of businesses.

Virginia CEOs Concerned by Increasing Interest Rates and Bank Failures

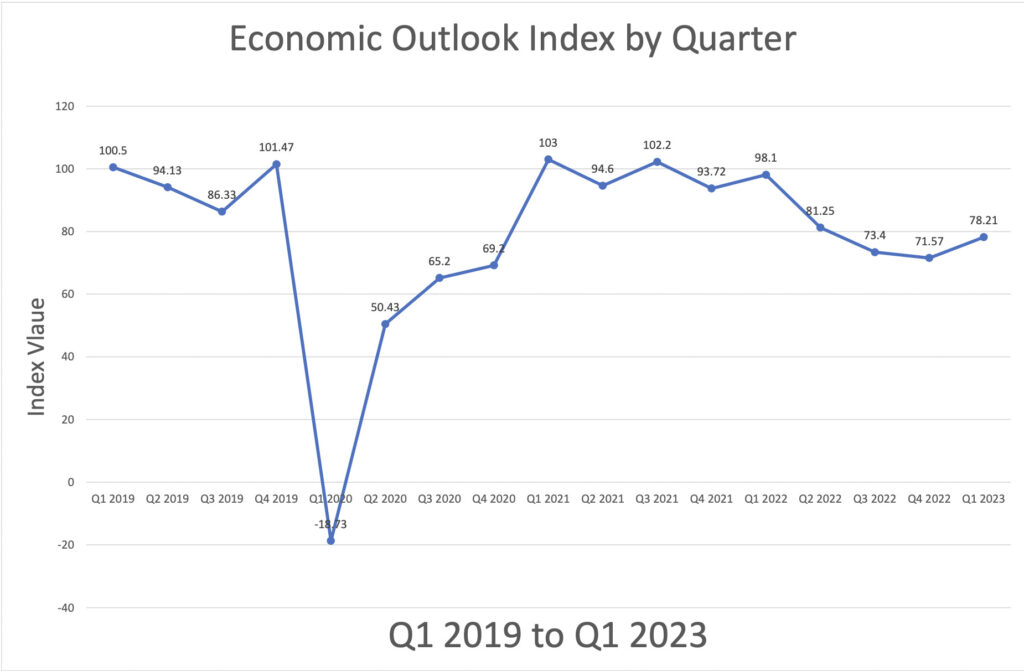

While interest rate increases and bank failures concern Virginia SMB CEOs, their economic outlook is rebounding for the first time since Q1 of 2022.

That’s the latest from the quarterly CEO Economic Outlook Survey conducted by the University of Richmond’s Robins School of Business and the Virginia Council of CEOs.

- 49% of CEOs indicate that the rapid rise in interest rates has negatively impacted their business, while only 2% indicate that the interest rate increases have positively impacted their business.

- 31% of CEOs have at least considered changing their banking practices due to the recent bank failures.

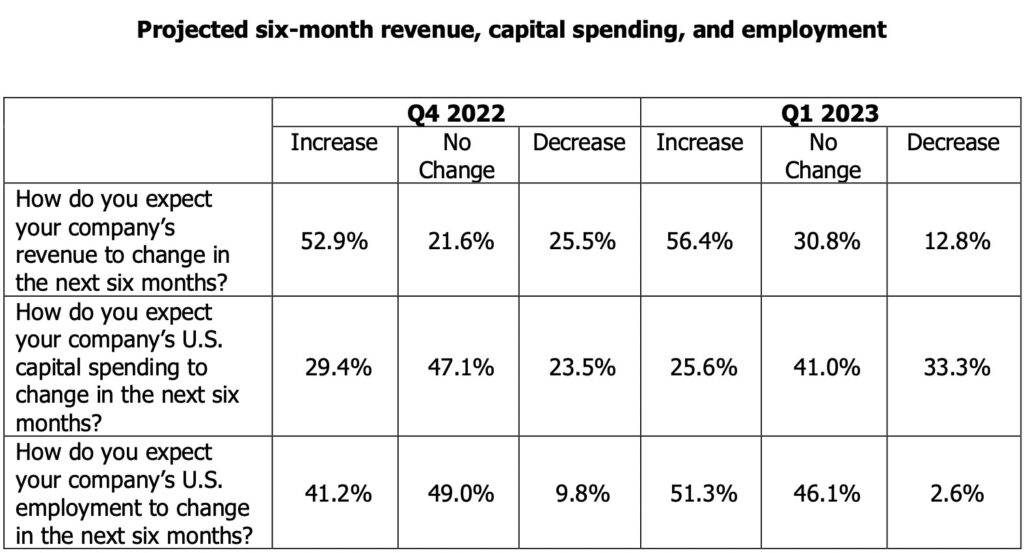

- 56% of CEOs expect revenue to increase with 30% expecting at least a 10% increase, while 51% expect employment to increase over the next six months.

The survey also found expectations over the next six months for revenue and employment were both positive and expected to grow faster than predictions from last quarter. Expectations with regard to capital spending remained primarily flat.

“The survey results suggest that CEOs see a more positive future than they have for the last 12 months. They have also felt a negative impact from the recent rise in interest rates,” said Rich Boulger, associate dean at the Robins School, who administers the survey and collects the responses. “The overall index is up for the first time in 12 months.”

More than half (56%) of CEOs indicated that they expect revenue to increase over the next six months.

- 5% expected revenue to be “significantly higher.”

- 51% expected revenue to be “higher.”

- 13% expected revenue to be “lower.”

- 31% indicated they expected no change.

About a quarter of CEOs (26%) expect capital spending to increase over the next six months (down slightly from last quarter), while 33% expect capital spending to decrease. More than 41% expect capital spending to remain flat.

Half of respondent CEOs (51%) expect employment to increase over the next six months. Additionally, 46% expect employment to remain flat while only 3% expect employment to fall.

Taken as a whole, the results pertaining to revenue, capital spending, and employment are more positive than any quarter since Q1 2022 with the overall Economic Outlook Index increasing (78.2 versus 71.6) relative to the results from the end of Q4 2022.

Additionally, CEOs were asked how the recent interest rate increases (from 0.25% to 5% over the last 12 months) have impacted their business. They reported:

- Little to no impact: 49%

- Negative impact: 49%

- Positive impact: 2%

They were also asked how the recent bank failures have impacted their banking practices. They reported the following:

- After evaluation, comfortable with current banking practices: 69%

- Have considered switching banks but have not: 23%

- Have made some major change to banking practices: 8%

“I think the continued optimism reflected in this survey represents the nimbleness of these small business CEOs. While most are concerned over higher interest rates, they have been able to adapt and continue to grow,” said Scot McRoberts, executive director of VACEOs.

The Robins School and VACEOs jointly conduct the quarterly survey, which regularly asks about expectations for revenue, capital spending, and employment, plus other relevant issues, helping Virginia companies anticipate business conditions and plan for growth. The Robins School adapted the survey from the Business Roundtable, an association of CEOs of American companies that conducts a similar survey nationally. Rich Boulger, associate dean at the Robins School, administers the survey and collects the responses. The quarterly survey has been administered since 2010.

Thirty-Nine CEOs responded to the survey, which was administered April 4 – 11. Multiple industries are represented in the sample although services and financial services represented the majority of the respondents. The average company whose CEO responded to this survey had about $10 million in revenue for the most recent 12-month period. The average employment was 56.

Richmond Fed President Tom Barkin’s Remarks at VACEOs Luncheon Covered Widely

Tom Barkin, President of the Federal Reserve Bank of Richmond, spoke at the Virginia Council of CEOs Quarterly Luncheon on March 30th. He expressed his desire for the Fed to remain nimble as they deal with the challenges facing our economy. Read his speech and media coverage here:

The Need to be Nimble – The Federal Reserve Bank of Richmond

Richmond Fed Bank President urges the need to be nimble after rate increase – Richmond Times-Dispatch

Barkin: Raising interest rates is correct course – Virginia Business

Barkin Says He’s Undecided on Rate Move at Next Fed Meeting – Bloomberg

Bank deposit flows stable, inflation still hot – Yahoo!Finance

Fed’s Barkin: No view yet on rate hike appropriate for May meeting – Reuters

Fed’s Barkin sees ‘pretty wide’ range of possible outcomes for path of interest-rates – Market Watch

Economic Outlook – We Talk to 3 CEOs

As inflation continues to plague CEOs, their economic outlook for the next six months isn’t all doom and gloom. Most CEOs report sales and employment remain bright spots on the road ahead.

The latest quarterly CEO Economic Outlook Survey conducted by the University of Richmond’s Robins School of Business and the Virginia Council of CEOs asked CEOs to share their experiences with inflation as well as their expectations for sales, employment, and capital spending over the next six months.

We took the results to three VACEOs members in three distinct areas — retail, manufacturing, and business-to-business service — to ask for deeper insight behind the numbers.

INFLATION CHALLENGES CONTINUE

Unsurprisingly, a large majority of CEOs — 84 percent — reported negative impact to their business due to inflation. Looking ahead, 55 percent of CEOs also expect inflation to continue rising above current levels over the next six months, bringing continued pressure on and requiring continued resilience from CEOs.

For the CEOs we spoke to, inflation’s impacts hit on many fronts, from rising costs to wage pressure to how and when to adjust pricing in the market.

“For us, the biggest negative impact has been wage inflation and trying to keep up with it as our employees struggle with reduced buying power from their checks,” says Travis Hamilton of u-fab Interiors. In the last 6 months, Hamilton says u-fab has been buying more stock of both furniture and fabrics to help mitigate supply chain delays while locking in costs.

Another struggle for us has been, as a retailer, it’s very hard to raise our prices as quickly and often as our suppliers have been doing, which has cut into our margins.

Travis Hamilton, u-fab

Inflation has also impacted pricing in the business-to-business service space. “We’ve had to adjust our pricing quickly to compensate for unexpected wage increases,” says Chris Leone of WebStrategies, adding that wage pressure forced the business to go well beyond budget for 2022. “We continue to invest heavily in our offerings to help justify the increased cost to our clients.”

Leone is also conscious of longer-term impacts. “We need to be responsive to the changing environment while not overcorrecting too much,” he says. “The last thing we want is to have to make drastic changes internally in the event of a significant downturn. It’s a fine line to balance the intense short-term needs while not positioning us poorly for the long term.”

Eventually we did start raising prices and found little to no resistance from our customers. ‘Ability to deliver’ has been the focus of our customers, not price sensitivity.

Manufacturing CEO

The manufacturing CEO we spoke to has raised prices as well, and did so without significant pushback from customers. “As the costs for commodities and other materials rose, we were a little slow to raise prices,” he says. “Eventually we did start raising prices and found little to no resistance from our customers. ‘Ability to deliver’ has been the focus of our customers, not price sensitivity.”

SALES AND EMPLOYMENT STILL GROWING

On the positive side, CEOs expect growth to continue despite this challenging market, although their optimism is diminishing. In the new survey, 59 percent of CEOs said they expect their sales to increase over the next six months, with 28 percent expecting at least a 10 percent increase. For employment, 52 percent of CEOs expect an increase as well. These growth projections, while positive, have shrunk compared to CEOs’ projections following the Q1 2022 survey. After Q1, 70 percent of CEOs reported an expectation for sales to increase, and 67 percent reported an expectation for employment to increase.

It’s worth noting a larger percentage of CEOs are now reporting they expect sales and employment to hold steady following Q2 compared to Q1 — so while growth projections are more conservative, sustainability projections have increased. After Q1, a total of 89 percent of CEOs indicated sales would grow or stay the same, while after Q2 that combined number dropped to only 87 percent. The same is true of employment, with a total of 95 percent of CEOs indicating employment would grow or stay the same after Q1, with that combined number dropping to only 91 percent after Q2. The good-news takeaway here is stability.

For two of the CEOs we spoke with, a strategic approach to customer retention and acquisition will drive growth in sales and market share.

We’re narrowing our focus to fewer target markets so we can offer the most sophisticated and effective solutions.

Chris Leone, WebStrategies

“We’re narrowing our focus to fewer target markets so we can offer the most sophisticated and effective solutions,” Leone says. “We believe that as competition increases and customers feel more empowered, firms that are best positioned to solve their specific issues will be the most successful.”

“Careful selection of which new customers we choose to work with will be important for our growth in the next six months,” says the manufacturing CEO. “We know the demand is high and this is a rare time to gain market share. We know the tide will go back out eventually, and we want to be with the customers that are good long-term fits.”

For retail, it’s a different story.

“Being in the home goods market, the Covid years have been very, very strong, and we’ve seen substantial sales growth, but we expected and are already seeing a leveling off of this demand,” Hamilton says. “We don’t expect to see sales growth over the next six months. With increased prices, we do expect to sales to remain relatively flat, albeit at somewhat reduced volume.”

Keeping up with employment demands to support growth in this environment has presented CEOs with unique challenges. CEOs have learned valuable lessons ranging from recruiting to compensation to the employee experience, all in their effort to better compete for talent.

We blew up our hiring, onboarding, and training program and started from scratch.

Manufacturing CEO

“We blew up our hiring, onboarding, and training program and started from scratch,” says the manufacturing CEO. “In order to reach a broader pool of candidates, we changed our hiring criteria and how we marketed the positions. We invested heavily in onboarding — creating a dedicated full-time role for onboarding — to help people make the transition to a new industry. We also created a slate of training courses and structured skill development paths.”

“We’ve increased our wages across the board to try to mitigate the effects of inflation on our employees,” says Hamilton at u-fab Interiors. “We are very lucky that we have always had, and continue to have, extremely low turnover. But we’ve definitely had our employees communicate their struggles with us more than ever over the past six months.”

“Every company I know of is struggling with some combination of recruitment and retention. Given the abundance of job openings, employees have felt very empowered and are using that leverage to find the best possible fits,” says Leone.

A strong company culture, competitive compensation, and flexible work environments are necessary to attract and retain good talent today. If we don’t offer it, someone else will.

Chris Leone, WebStrategies

“We are listening to and engaging with our team members more than ever before,” Leone continues. “We recently hired a Director of People Operations so we can become more intentional about the employee experience. We’ve always been very proactive with listening to our employees, but this move has taken things to a new level.”

CAPITAL SPENDING HOLDING STEADY

According to the report, the quarterly outlook for capital spending is a mixed bag. Most CEOs — 43 percent — expect capital spending to remain flat. An additional 31 percent of CEOs report they expect capital spending to increase, while 25 percent expect it to decrease.

U-fab’s Hamilton is in the majority when it comes to his projection for capital spending. “Our capital spending will remain flat or likely decrease over the next six months as we wait to see what this next new normal of the post pandemic looks like for the home furnishings industry as a whole,” he says.

In fact, “adjusting to the next new normal” is exactly what CEOs are challenged to do right now as they deal with post-pandemic impacts to compensation, pricing, and recruitment. At the same time CEOs are facing 2022’s “new normal” of record-high inflation, unstable financial markets, and the shadow of a recession the likes of which we haven’t seen since the late 2000s. We can only hope Q3 economic outlook among CEOs remains strong. Stay tuned.

You can find the data from this quarter’s survey in this University of Richmond Robins School of Business release.

How Small Business CEOs Adapt to Labor Shortage

In our most recent CEO Survey, 90% of respondents reported that they are experiencing a labor shortage impacting their business.

So, we asked members to share how they have adapted their business models with the VACEOs community through our private social network, VACEOs Connect. Here are some of their stories.

CEO of a Regional Engineering Firm

I’m happy to say that the labor shortage is forcing our firm to accelerate what I felt was going to be an inevitable, but slow shift in our clients and markets. I’ve been saying for years that once we are committed to working with only those clients who value our services, we will see the list of markets and client types shrink, resulting in higher revenues with more profitable clients. With the inability to serve everyone who seeks our services, it has been easier to say yes to our long-term clients who value us and to say no to the newcomers who are shopping for a low-priced commodity or a one-off project.

In summary, while the labor shortage has been painful and costly, I feel we will come out of this better than we went into it.

Owner of a Tech Services Firm

We are a tech services company that has enjoyed a healthy culture of being in the office together 5 days a week. However, because of the shift in the tech industry I compete with employees and salaries from all over the United States, forcing me to a hybrid model – 95% remote, a few of us left in the office a couple of days a week. With the significant increase in salary demands from tech workers, I have been forced to hire nearshore (Latin America) developers instead of US-based developers. The nearshore developers are good, but the language barrier or heavy accents and differences in culture have proven to have a negative impact on our client experience. Our future plans for hiring include fewer US-based employees and more nearshore. We are planning on hiring more experienced, client-facing, US developers for a premium and supplement with nearshore. For example, where I would have usually hired two or three US developers, I will likely hire one US developer and one to two nearshore developers.

President of a Custom Kitchen & Bath Design Company

Our goal used to be to install every project we sold, for quality control and to offer a turn-key experience. Now, due to skilled labor shortage, we have increased the price for us to install. This has two purposes: 1) to pay my installers more and thus increase loyalty, and 2) to make the cost of professional installation a true investment in the product/project rather than something the client takes for granted. No one has pushed back.

We also have a severe shortage of truck drivers. We have been hiring out deliveries more often and paying 300% more than in-house deliveries. Again, no one is pushing back and asking to pick up their products at our warehouse.

And thirdly, we have tightened our trading area. We love doing projects all over the state (and country), but with no trusted trades in outlying locations, we have decided not to take on those projects.

Not All Businesses Impacted Negatively

Ten percent of the businesses in our survey have not experienced

negative impacts of the labor shortage. Here’s one example.

Founder of Marketing Agency

Fortunately, our business model was designed to use a fully remote, independent workforce. That put us in a great position for The Great Resignation because many brilliant marketers decided to work independently. That’s given us access to more good people.

Takeways

Small and mid-sized businesses tend to be more nimble than large corporations. We’ve seen the leaders of these organizations make hard and soft pivots to remain competitive. Think in terms of quarters instead of years.

Actions you can take

- Eliminate or add lines of business, territories, products, services.

- Analyze low-profit customers and replace with more profitable ones.

- Invest in automation, software, or equipment that reduces labor demands.

- Increase prices to reflect the cost of doing business.

- Outsource or partner instead of hiring

Scot McRoberts wrote this post. He is founding executive director of the Virginia Council of CEOs.

Recent Comments