Follow the Leaders

Virginia Economic Outlook Index Flat Versus Q2; Ninety-Eight Percent of CEOs Prefer the Fed to Hold or Reduce Interest Rates; Sixty-four percent Have Concerns About Inflation and Revenue

CEOs Again Expect Revenue and Employment to Increase Over Next 6 Months with Capital Spending Remaining Flat

Ninety-eight percent of small business CEOs indicate that they prefer that the Fed either reduce interest rates or hold them at the current rate with only 2% preferring that rates increase further. Sixty-four percent of respondents view inflation and revenue concerns as the biggest challenges facing their business in the near term versus 74% in a national survey by the U.S. Chamber of Commerce. That’s the latest from the quarterly CEO Economic Outlook Survey conducted by the University of Richmond’s Robins School of Business and the Virginia Council of CEOs.

Fifty-four percent of CEOs expect revenue to increase, with 23% expecting at least a 10% increase, while 50% expect employment to increase over the next six months.

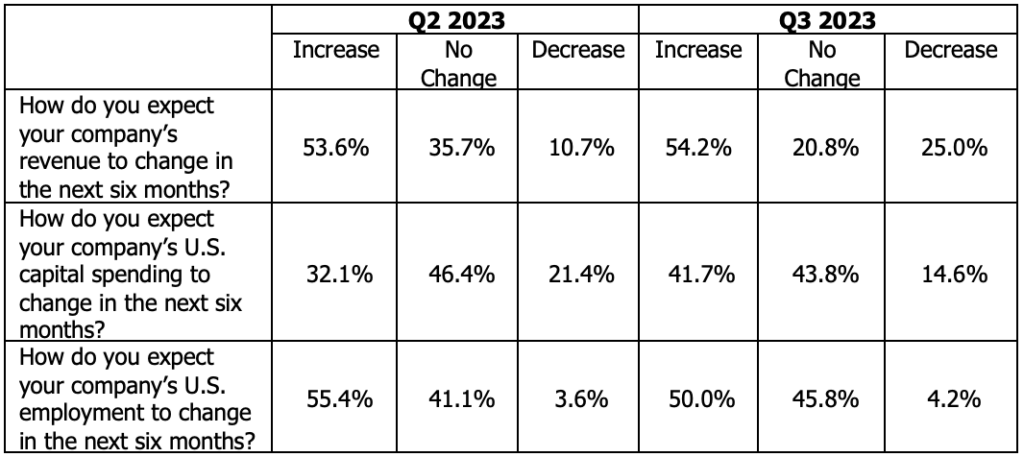

The survey found expectations over the next six months for revenue and employment were both positive with capital spending to grow slightly faster than expectations a quarter ago.

More than half (54%) of CEOs indicated that they expect revenue to increase over the next six months.

- 4% expected revenue to be “significantly higher.”

- 50% expected revenue to be “higher.”

- 25% expected revenue to be “lower.”

- 21% indicated they expected no change.

Forty-two percent of CEOs expect capital spending to increase over the next six months (up slightly from 32% last quarter), while 15% expect capital spending to decrease. Forty-four percent expect capital spending to remain flat.

Fifty percent of respondent CEOs expect employment to increase over the next six months. Additionally, 46% expect employment to remain flat while only 4% expect employment to fall.

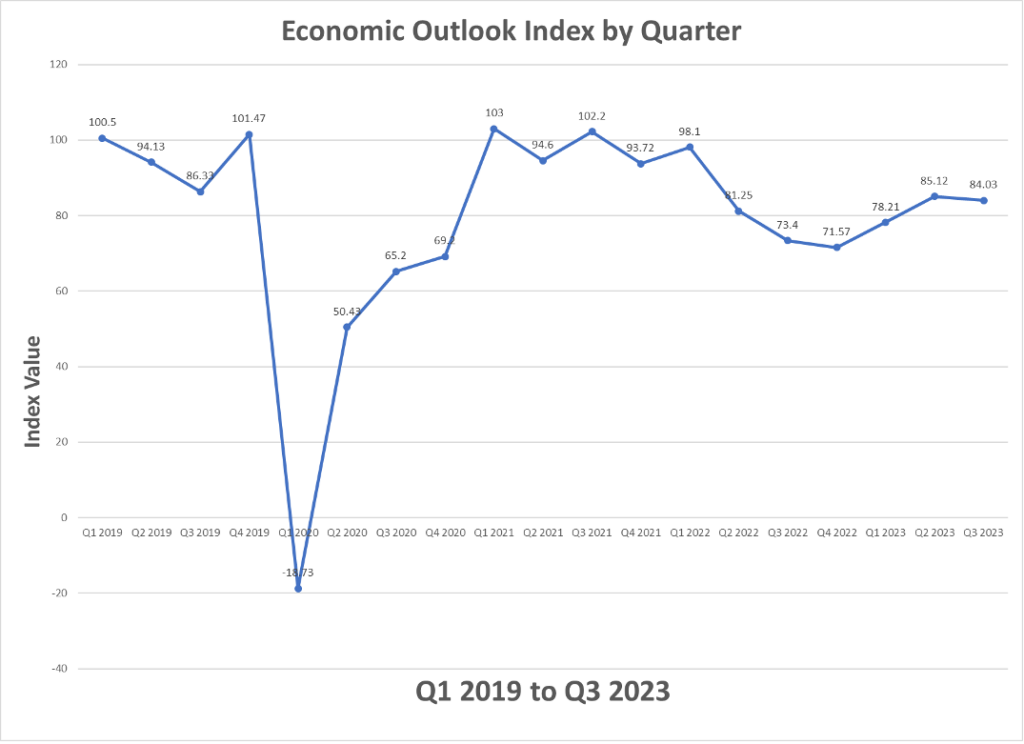

Taken as a whole, the results pertaining to revenue, capital spending, and employment expectations are down very slightly from last quarter with the overall Economic Outlook Index decreasing (84.0 versus 85.1) relative to the results from the end of Q2 2023.

Additionally, CEOs were asked their preference with regard to further interest rate changes by the Fed. They reported that they preferred the following:

- Further raise rates: 2%

- Reduce rates: 44%

- Leave rates as they are: 54%

They were also asked to rank order the challenges facing their businesses in the near term. They reported the following as the most challenging:

- Inflation: 32%

- Revenue Concerns: 32%

- Interest Rates: 23%

- Supply Chain Issues: 13%

“The survey results suggest that CEOs have positive revenue growth expectations but see inflation as an ongoing item of concern. They also strongly prefer that the Fed avoid further interest rate hikes” said Rich Boulger, associate dean at the Robins School, who administers the survey and collects the responses. “The overall index is approximately flat (84.0 versus 85.1 at the end of Q2 2023) and up from 73.4 of a year ago.”

“The sentiment from CEOs I am talking with lately is far more pessimistic than this data. The storm clouds they are seeing must be beyond the survey’s six-month outlook!” said Scot McRoberts, executive director of VACEOs.

The Robins School and VACEOs jointly conduct the quarterly survey, which regularly asks about expectations for revenue, capital spending, and employment, plus other relevant issues, helping Virginia companies anticipate business conditions and plan for growth. The Robins School adapted the survey from the Business Roundtable, an association of CEOs of American companies that conducts a similar survey nationally. Rich Boulger, associate dean at the Robins School, administers the survey and collects the responses. The quarterly survey has been administered since 2010.

Forty-eight CEOs responded to the survey, which was administered October 4 – 10. Multiple industries are represented in the sample although services and construction represented the majority of the respondents. The average company whose CEO responded to this survey had approximately $10 million in revenue for the most recent 12-month period. The average employment was 45.

The Council continues to expand the survey beyond its members, offering any area business owners whose companies gross at least $1 million in annual revenue the opportunity to participate. If enough businesses participate, the Council will provide survey results by industry. Participation is free, and all participants will receive copies of the survey data.

Business owners and CEOs who would like to participate in the next survey should contact Scot McRoberts at smcroberts@vaceos.org.

Virginia Council of CEOs (VACEOs) is a nonprofit organization connecting CEOs for learning and growth. Formed more than 20 years ago, member benefits include placement in a peer roundtable group and access to a thought leader network, and a robust program of events for learning and growth. This is not a networking group, but rather a group of CEO peers who are invested in the success of each Member. To qualify for membership CEOs must run a business with $1M+ revenue and 5+FTEs. Learn more at www.vaceos.org.

The Robins School of Business is the only fully-accredited, highly-ranked undergraduate business school that also is part of a highly-ranked liberal arts university. The Robins School is also home to the Richmond MBA. The school’s executive education division offers customized training and consulting to a wide variety of businesses.

Leave a Reply