How VACEOs Members Are Leveraging AI Tools Today

Two dozen VACEOs members convened in late June to share with one another how they are using generative artificial intelligence (GAI) tools in their businesses. Here’s what we learned.

There are three primary ways these small business owners are using GAI tools.

- To do stuff for me – create a blog, a policy, an image, or a social media post

- To educate me – gather information on a specific interest, help me understand something

- To inspire me – the ultimate brainstorm starter to get the ideas flowing

And, what these entrepreneurs said is that it all comes down to the prompts. Get better at the prompts you give GAI, and you will get better results. They said:

- Give background and context in your prompt.

- Give as many details as possible.

- Keep asking to get to a better response. Each follow-on prompt is taken in the context of the previous prompts.

Finally, we had ChatGPT summarize the transcript of the conversation. Here you go!

They mention using it for various purposes such as creating job descriptions, drafting policies, generating marketing content, transcribing meetings, and even generating images. They highlight the convenience and time-saving aspects of the tool. The participants also discuss potential future applications, such as summarizing recorded calls, generating email responses, and creating executive compensation benchmarking reports. Overall, they express positive experiences with chat GPT and its potential for various business and personal use cases.

Meeting transcript summarized by ChatGPT

Many thanks to board member Chris Leone for facilitating this conversation.

VACEOs members can access the recording of this 60-minute Zoom meeting at VACEOs Connect. Look for Quick Links on the bottom right, and go to “Download Event Replays.”

Additionally, several members have formed a new community on VACEOs Connect for those who are active users of GAI to share their experiences with one another. Contact us if you would like to join this group.

AI-Powered Automation to Transform Finance, HR, and Sales

With every prompt you put into ChatGPT or another of the large-language artificial intelligence models producing so much buzz lately, you’re powering forward the next incredible shift in modern business operations.

These shifts began with the personal computer, which boosted output and made business fundamentals easier to accomplish. Then the Internet connected and accelerated everything. And now, AI, as it intersects with process automation, promises to deliver unprecedented new efficiencies across core functions.

The benefits will be immense, enabling organizations to achieve higher levels of productivity, accuracy, and strategic decision-making.

To better understand what’s coming down the pike, I asked colleagues at Fahrenheit (and also ChatGPT!) about what CEOs can expect as AI and automation integrate with finance, HR, and sales departments.

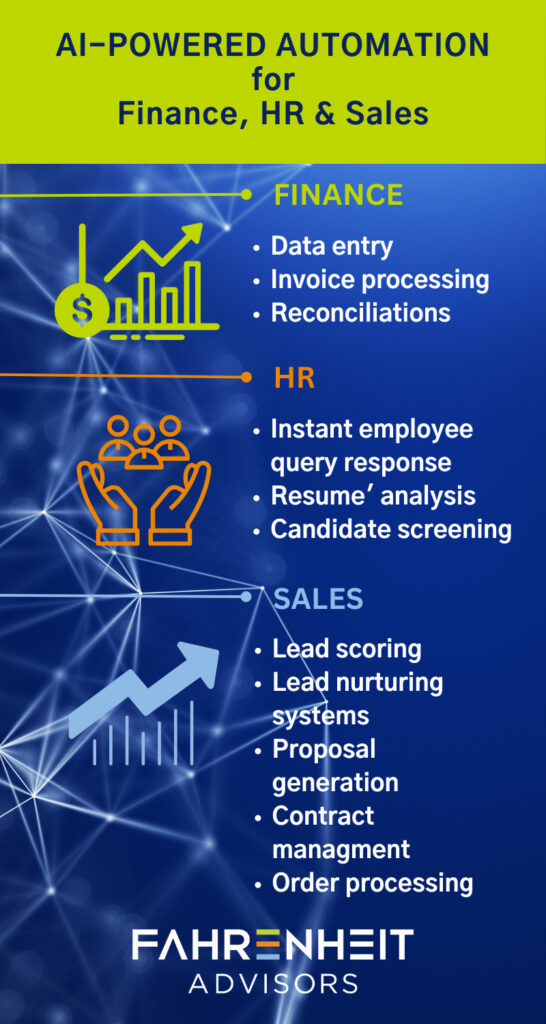

Finance: Unlocking Efficiency and Accuracy

Automation tools can revolutionize finance functions by reducing manual tasks, minimizing errors, and improving overall efficiency. Tasks such as data entry, invoice processing, and reconciliations can be automated, freeing up valuable time for finance professionals to focus on strategic activities.

Automation in finance also enhances accuracy and compliance. AI algorithms can analyze vast amounts of data, identify patterns, and detect anomalies, reducing the risk of fraudulent activities. With real-time insights provided by automation, financial decision-makers can make informed choices, improve forecasting accuracy, and identify cost-saving opportunities.

“Automation, AI, and algorithms may sound daunting to mid-market or small business CEOs, but they shouldn’t,” said Mark Vita, Business Advisory and Finance & Accounting practice leader for Fahrenheit Advisors. “Often the software and technology you already use can be configured to automate processes, analyze data, and deliver strategic insights for faster work and better decision making, and it’s just going to get better.”

HR: Empowering the Workforce and HR Pros

Human resources departments manage an organization’s most valuable asset: its people. Automation in HR streamlines administrative tasks, allowing HR professionals to focus on strategic initiatives like talent acquisition, talent development, and employee engagement. Automating tasks such as employee onboarding, leave management, and performance evaluations enhances the employee experience and frees up time for HR teams to engage with employees on a more personal level.

AI-powered chatbots and virtual assistants can respond instantly to employee queries, delivering personalized assistance and reducing the need for human intervention. Additionally, automation can improve recruitment processes by analyzing resumes, screening candidates, and identifying the best matches, leading to more efficient and effective talent acquisition.

“CEOs should not overlook the value of automation to the HR team,” said Laura Bowser, Human Capital practice leader for Fahrenheit Advisors. “The pandemic-driven changes in the workforce and workplace will continue to drive new trends, regulations, and policies that will need the HR team’s full attention. AI and automation will help them give it.”

Sales: Enhancing Productivity and Customer Experience

Automation significantly enhances a sales team’s productivity and contributes to delivering exceptional customer experiences. CRM (Customer Relationship Management) systems powered by AI can provide valuable insights into customer behavior, preferences, and purchase patterns, enabling sales teams to tailor their strategies and offerings accordingly.

Automated lead scoring and nurturing systems also can analyze customer interactions and engagement data to identify high-potential leads and guide sales representatives on the best approach to engage with them. Automation also can streamline the sales process by automating repetitive tasks, such as proposal generation, contract management, and order processing, enabling salespeople to focus on building relationships and closing deals.

“Taking a business to the next level requires accelerating and increasing sales,” said John Atkinson, Sales Advisory practice leader for Fahrenheit Advisors. “Small investments in automation tools can deliver major returns as sales teams benefit from sharper strategies and more efficient processes.”

The Road Ahead Isn’t Scary — Unless Competitors Run it Faster

AI is not a replacement for human intelligence but a powerful tool that complements and augments human capabilities. This article is proof. Feeding the right prompts into ChatGPT automatically generated a framework and usable copy in seconds, allowing me to focus on editing, fact-checking, and fine-tuning the key message I want to share.

And that message is this: for finance, HR, and sales departments, automation frees human potential from mundane and repetitive tasks, empowering professionals to leverage their skills, expertise, and creativity to drive innovation and strategic decision-making.

Implementing AI and automation must be accompanied by robust data governance and ethical frameworks to ensure transparency, privacy, and security. And businesses need to prioritize reskilling and upskilling their workforce to adapt to the changing landscape, fostering a culture that embraces technology as an enabler rather than a threat.

Those that do embrace AI and automation will enjoy operational efficiencies that drive growth and protect against setbacks. Those that don’t will find themselves running faster and faster to chase competitors.

Rich Reinecke is co-founder of Fahrenheit Advisors, a Richmond-based business advisory firm.

Productivity for SMB CEOs

Apps, processes, discipline, and little orange books.

We recently had an online “Square Table” gathering of VA Council of CEOs members to learn from one another on how to be more productive in our work and lives. Here are some of the ideas and tools that work for these entrepreneurs, business owners, and CEOs.

Email, the bane of our existence

- Inbox Zero is possible, and at least one or two of the CEOs in meeting do it daily. Here’s how, from Ari Meisel, who spoke at our Spring Retreat a few years ago. Basically, you make a decision on every email the first time you look at it — DO, DEFER, DELEGATE, or DELETE.

- One person uses four email addresses. They help him separate out personal, business internal, business external, and marketing.

- Unroll.me is a tool used by some. Some email clients have unsubscribe functions that are easy to use. Just don’t unsubcribe from VACEOs mail!

- Many folks use filters and rules to automatically move emails to folders. For example, I have a filter I use to move all email from speakers and meeting venues (it’s a lot) to a folder for later review.

- Some use Slack or Teams for internal communication, reducing email volume.

Mind Like Water . . .

- David Allen, author of Getting Things Done, talks about Mind Like Water, and defines it as “a mental and emotional state in which your head is clear, able to create and respond freely, unencumbered with distractions and split focus.” Achieving that is the trick! Following are several tricks mentioned by this group of CEOs.

- Block your time. Mark out time on your calendar for one thing without distraction – reading, writing, meeting prep, yoga, whatever.

- You brain is not good at storing information. It is made for processing. So, do whatever you can to get information offloaded and stored elsewhere. Evernote and OneNote make it easy to organize notes, store documents and set reminders.

- Use Hey Siri! or Hey Google! and tell them to remind you when you need to know.

- Some CEOs, even those who have small organizations, make use of an assistant – either someone in their business or a virtual assistant.

- Several people mentioned using journal books – the orange VACEOs books are a favorite. Some use them just for notes, others use them to list that day’s to-do list. I use a Full Focus Planner, which helps me organize my day’s work without digital distraction.

- Ari Meisel introduced me to FollowUpThen, which allows you to bcc an email and have it return to my inbox at a certain time. Gmail has similar functionality built in.

Is your time worth more than $15 an hour?

- Meetings Suck! And they waste a ton of time, as Cameron Herold taught VACEOs members a few year ago. A key takeaway — No Agenda, No Attenda!

- Calendly save you hours of back and forth trying to schedule meetings. Just send someone your Calendly link and let them choose from among available times.

- Have you (the business owner) ever spent an hour or more searching for the best deal and route for a $350 flight? Old school tip — use a travel agent. The do the searching, present you the options, and when your get stuck in Denver, you have someone to call who can actually help you get another flight. The cost is minimal.

- Finally, one CEO said that she regularly stops and asks herself, “Why am I doing this $15 an hour work? Shouldn’t I be spending my time on $1,000+ an hour work?”

What are your favorite productivity tools, hacks, and tips? Share in the comments!

4 Tips to Help Introverted Leaders Succeed in the Workplace

It is widely believed in Western culture that to be a great leader you should be an extrovert. “You need to be able to walk in front of a microphone in front of a big group, capture the crowd and be charismatic be outgoing. Think politicians, kissing babies. And that is far from the truth, explains Brad Eure, co-founder of Eure Consulting. Adding, “There are a lot of strengths that extroverts have. There are just as many that introverts have.“

According to Eure, introverts make up nearly half the population. If you think you are an introvert, you are far from being alone.

Introverts: Why the Bad Wrap?

A hundred years ago, Carl Jung defined a person as being either introverted or extroverted by how they process the world around themselves and how they get and spend energy. There are varying degrees of each, and a person can be considered an ambivert, but to simplify it: extroverts seek out and get energy and stimulation from their outside environment. It energizes them. Introverts are the opposite.

For many introverts, quarantine life today is a little easier, as most of the mixing and mingling and interruptions they encountered pre-pandemic has come to a standstill.

Introverts are sometimes stereotyped as “anti-social” or “shy”, but those traits are found in extroverts as well. “Being shy is social anxiety and it affects both introverts and extroverts,” says Eure.

“Introversion is not anti-social, is not “curable” because it is not a disease. It isn’t a choice. It is not right. It’s not wrong. It is just who you are. And it doesn’t disqualify you from being a good leader. We have found that introverts are phenomenal leaders. All of us have our strengths and all of us have our weaknesses,” he adds.

Quiet, Introvert in the House

Do you find that you often need to retreat to a quiet space to concentrate, reflect, or rest? You don’t like to rush decisions, are comfortable when alone, and prefer to write rather than talk?

If some of these traits sound like you, congratulations! You are more than likely an introvert. You have a unique self-awareness. Use that and these tips to help you be the best communicator and leader you can be.

4 Tips to Help Introverts Manage Themselves, Meetings, and Others*

#1) Own who you are.

Some may think extroverts are “natural” leaders but don’t try to be something you are not. Replace myths about leadership with truths. Be yourself, be authentic and be open and honest. This will build trust. Purposely surround yourself with people who complement your abilities and style.

Bonus tip: Eure suggests checking out “The Five Dysfunctions of a Team: A Leadership Fable” by Patrick Lencioni.

#2) Become adept at facilitating meetings when introverts and extroverts are together.

Eure reports that extroverts often dominate meetings and speak without thinking. They think passion/words/volume proves their arguments. Facilitate meetings with that in mind. Ask questions and speak up last. Draw out comments from other introverts and let them know ahead of time that you will seek their input. Like you, they want to have time to think about how they will answer.

Bonus tip: Set ground rules or Rules of Engagement for your meetings to ensure a safe space.

#3) Clearly define roles, expectations, values, and processes.

The best way to manage introverts and extroverts is by clearly defining roles, expectations, and core values. Schedule regular feedback sessions that are clear, consistent, caring, candid, and challenging. Create and strictly follow processes for everyone. Understand extrovert traits so that you are not put off by them and can lead them in the most effective way.

Bonus tip: Eure likes the Radical Candor approach.

#4) Understand the dynamics of communicating with an extroverted salesperson.

Eure reports that extroverts, especially salespersons, need to understand how their actions affect others. Keep in mind they can have sporadic listening skills. Document conversation details when appropriate and have them commit to modes of action and hold them accountable. Be able to read the body language for approval or disapproval, and praise them for their achievements.

Measurement is Key for Continued Development

Many CEOs find that hiring a consulting firm to assess their team’s personal behavior styles can be a gateway toward a strong team dynamic. While you are at it, consider engaging that firm to help establish your company’s own set of Meeting Rules of Engagement — one that balances the needs of extroverts and introverts alike.

Heartfelt thanks to Brad and Clay Eure of Eure Consulting for their assistance with this article.

*Source: “How to Lead As An Introvert”, 2021 presentation by Brad and Clay Eure, Eure Consulting.

How to Be a Better CEO in 2021

Last year at this time, I asked the members in my peer roundtable “What are your professional development plans for next year?” I was shocked when two of these CEOs said that they had done all that stuff, that they were within 5 years of exiting, and that they really didn’t see a need for it. It seemed like they had decided to just coast to the finish line of their careers.

Maybe when I am closer to retirement, I will have that attitude, but I hope not. I believe that there is unlimited potential for growth, and that if I am to be the leader my organization needs and deserves, I need to work on myself continually.

I think I am a pretty good CEO. So, what’s wrong with being the same kind of CEO again next year? Well, are my competitors sitting still or getting better? Is the pace of change in business and society slowing down? I don’t think so. If I am to lead my business to compete and thrive amidst rapid change and the unexpected (pandemic, anyone?) I must continue to learn and grow.

So I encourage you, my fellow CEOs, to make a decision about how you will grow as a leader in 2021. The options are endless. You could take a class, join a book club, retain a coach, or join a peer roundtable.

Be a better CEO in 2021. Make a decision now on how you will learn and grow.

About the Author

Scot McRoberts is the executive director of the VA Council of CEOs (VACEOs). One of the original co-founders, he has led the organization’s growth from 20 members in 2000 to more than 200 today. Utilizing a best practice model for the Council’s CEO roundtables and a dogged focus on its core purpose of connecting CEOs for the purpose of sharing experiences, McRoberts has developed an association that boasts 90% retention. Before coming to VACEOs, Scot was a senior executive at the Greater Richmond Chamber of Commerce, where he led business councils, small business programs, and business retention efforts.

Recent Comments