Follow the Leaders

VA Economic Outlook Improves Significantly in Q1, Approaches Pre-pandemic Level

“The federal stimulus has certainly done its job. The main challenge for these CEOs now is acquiring the workforce to support this rapid recovery and growth.”

Scot McRoberts, executive director, VA Council of CEOs

Each quarter the Virginia Council of CEOs (VACEOs) and University of Richmond’s Robins School of Business partner to take the pulse of top executives in the region through a comprehensive Virginia CEO Economic Outlook Survey.

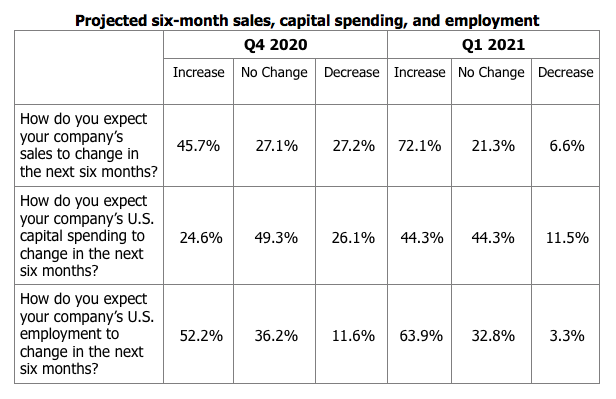

The first quarter 2021 CEO Economic Outlook survey finds that expectations over the next six months for sales, capital spending, and employment all improved compared with expectations at the end of Q4 2020.

VA Council of CEOs and Robins School of Business Historical Index Report

| YEAR | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2021 | 102.80 | |||

| 2020 | -18.73* | 50.43 | 65.20 | 69.20 |

| 2019 | 100.5 | 94.13 | 86.33 | 101.47 |

| 2018 | 94.60 | 92.73 | 104.30 | 97.97 |

| 2017 | 108.97* | 103.63 | 99.17 | 106.30 |

| 2016 | 102.00 | 89.00 | 89.67 | 107.37 |

| 2015 | 93.90 | 93.42 | 99.80 | 92.67 |

| 2014 | 86.07 | 88.71 | 96.10 | 95.92 |

| 2013 | 86.40 | 91.60 | 92.53 | 89.57 |

| 2012 | 94.10 | 81.13 | 81.17 | 77.57 |

| 2011 | 85.63 | 74.17 | 81.17 | 88.63 |

| 2010 | — | 81.33 | 94.47 | 92.27 |

| *historic high/low | ||||

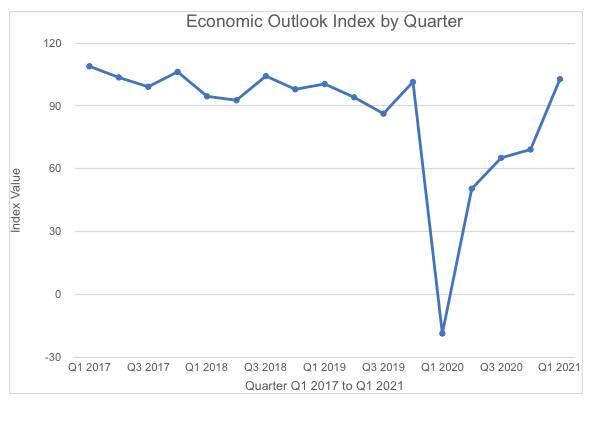

Says Scot McRoberts, executive director of the Virginia Council of CEOs, “The sharp V-shape of the data is consistent with what I am seeing in the small and mid-sized businesses with whom we work.” Adding, “The federal stimulus has certainly done its job. The main challenge for these CEOs now is acquiring the workforce to support this rapid recovery and growth.”

“The survey results suggest that CEOs are very optimistic about the next six months,” said Rich Boulger, associate dean at the Robins School. Boulger administers the survey and collects the responses each quarter. He adds, “The index has risen significantly (103.0% versus 69.2% last quarter). This increase returns the index to the pre-pandemic level of hovering around 100 since early 2017.”

EXECUTIVE SUMMARY: SALES, CAPITAL SPENDING, HIRING, AND VACCINATIONS

Taken as a whole, the results pertaining to sales, capital spending, and employment produce a significant improvement in economic outlook over results from the end of Q4 2020.

In addition to the survey questions regarding sales, capital spending, and employment, the survey asked CEOs to express their plans, if any, with regard to requiring employees to be vaccinated for COVID-19 prior to returning to work in person now or in the future. Their response regarding required vaccinations was as follows:

- Yes (will require vaccination): 8%

- No (will NOT require vaccination): 61%

- Unclear at this time whether vaccination will be required: 31%

Additionally, CEOs were asked what aspects of current business protocols (working from home, virtual meetings, hiring without in-person interviews) they see continuing post pandemic in a way that is advantageous to their business.

Many indicated that the flexibility to conduct internal and client meetings virtually was both a time saver and resulted in economic savings and will likely continue. A few indicated new benefits such as “leveling the playing field” against larger competitors with deeper pockets as well as being able to attract talent that may not live in the Richmond area. One CEO mentioned that there was a concern that it was becoming more difficult to maintain a common company culture with remote work.

To summarize, CEOs predictions over the next six months include:

SALES EXPECTATIONS

- 72 percent expect an increase in sales

- 5 percent expected sales to be “lower”

- 21 percent expect no change

REVENUE (compared to pre-COVID expectations)

- 33 percent reported reported Q1 2021 revenue as “much better than expected”

- 10 percent reported Q1 2021 revenue as “much worse than expected”

- 57 percent reporting revenue “about as expected”

CAPITAL SPENDING EXPECTATIONS

- 44 percent expect capital spending to increase (compared with 25% last quarter)

- 11 percent expect capital spending to decrease

- 44 percent expect capital spending to remain flat

EMPLOYMENT EXPECTATIONS

- 64 percent expect employment to increase

- 33 precent expect employment to remain flat

- 3 percent expect employment to fall

SURVEY SAMPLE

- 61 CEOs responded to the survey, which was administered April 8-15, 2021

- Multiple industries are represented in the sample, including professional services, health care, information technology, and finance

- The average company revenue (most recent 12-month period): $18 million

- The average employment count: 71

The following survey results from the last quarter of 2020 and the first quarter of 2021 show projections for the next six months for sales, capital spending, and employment.

ABOUT THE ECONOMIC SURVEY

The Robins School and VACEOs jointly conduct the quarterly survey, which regularly asks about expectations for sales, capital spending and employment, plus other relevant issues, helping Virginia companies anticipate business conditions and plan for growth.

The Robins School adapted the survey from the Business Roundtable, an association of CEOs of American companies that conducts a similar survey nationally. Rich Boulger, associate dean at the Robins School, administers the survey and collects the responses each quarter. The survey has been administered quarterly since 2010.

About Robins School of Business

The Robins School of Business is the only fully-accredited, highly-ranked undergraduate business school that also is part of a highly-ranked liberal arts university. U.S. News ranks the Robins School’s MBA program #2 in Virginia. The school’s executive education division offers customized training and consulting to a wide variety of businesses.

Recent Comments