Follow the Leaders

CEO economic outlook declines slightly; CEOs weigh in on makeup of next congress

Each quarter the Virginia Council of CEOs (VACEOs) and University of Richmond’s Robins School of Business partner to take the pulse of top executives in the region through a comprehensive “Economic Outlook Survey.”

The fourth quarter 2018 CEO Economic Outlook survey finds that Virginia CEOs’ expectations for sales and capital spending over the next six months fell compared to their expectations last quarter, while expectations for increased employment rose. Overall, expectations at the end of the year remained higher than their expectations in the first and second quarters of the year.

“In all industries and sectors, the CEOs I work with report that demand remains very high. Most don’t expect a recession until 2020,” said Scot McRoberts, executive director of the Virginia Council of CEOs.

“The survey shows that CEOs remain positive on the economy,” said Randy Raggio, Associate Dean at the Robins School of Business. Raggio administers the survey and collects the responses each quarter. He adds, “Despite recent drops in the stock market, most see strong demand and expect 2019 to be profitable.”

HOW WILL THE NEW CONGRESS MAKEUP AFFECT BUSINESS?

Last quarter, CEOs were asked how a Democratic takeover of Congress would impact the outlook for their business over the next 12 months. This quarter, with the results of the mid-term elections known, CEOs were asked what impact the new makeup of Congress would have on their outlook for the next 12 months. Although the questions were not identical, it appears that regional CEOs prefer the makeup of the upcoming Congress to one where Democrats control both chambers. Results are portrayed in the table below.

| December 2018 | September 2018 | |

| Large positive impact | 3% | 8% |

| Somewhat positive impact | 12% | 13% |

| No impact | 44% | 24% |

| Somewhat negative impact | 35% | 32% |

| Large negative impact | 5% | 23% |

EXPECTATIONS FOR EMPLOYMENT, SALES, CAPITAL SPENDING

The survey’s index, which measures executives’ views on projected hiring, capital spending and sales over the next six months, found that expectations for employment rose from last quarter. More than 60 percent of respondent CEOs expect employment to increase over the next six months, up nearly 3 percentage points from the third quarter survey. An executive summary of survey results is below.

EXECUTIVE SUMMARY

- More than 60 percent expect employment to increase (up 3 percentage points from last quarter)

- Seventy-one percent of CEO respondents expect sales to increase (down 8 points from last quarter)

- Expectations for capital spending fell from last quarter. Thirty-three percent of CEOs expect capital spending to increase (down nearly nine percentage points from last quarter)

- 91 CEOs responded to the survey, which was administered December 17-21

- Multiple industries are represented in the sample, including construction, manufacturing, finance and insurance and retail

- The average company revenue (most recent 12-month period): $10.5 million

- The average employment: 55

Economic Index Historical Data

| Year | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 |

|---|---|---|---|---|

| 2020 | -18.73 (historic low) | |||

| 2019 | 100.5 | 94.13 | 86.33 | 101.47 |

| 2018 | 94.60 | 92.73 | 104.30 | 97.97 |

| 2017 | 108.97 (historic high) | 103.63 | 99.17 | 106.3 |

| 2016 | 102.00 | 89.00 | 89.67 | 107.37 |

| 2015 | 93.90 | 93.42 | 99.80 | 92.67 |

| 2014 | 86.07 | 88.71 | 96.10 | 95.92 |

| 2013 | 86.40 | 91.60 | 92.53 | 89.57 |

| 2012 | 94.10 | 81.13 | 81.17 | 77.57 |

| 2011 | 85.63 | 74.17 | 81.17 | 88.63 |

| 2010 | 81.33 | 94.47 | 92.27 | |

ABOUT ECONOMIC SURVEY

The Robins School and VACEOs jointly conduct the quarterly survey, which regularly asks about expectations for sales, capital spending and employment, plus other relevant issues, helping Virginia companies anticipate business conditions and plan for growth. The Robins School adapted the survey from the Business Roundtable, an association of CEOs of American companies that conducts a similar survey nationally. Randy Raggio, associate dean at the Robins School, administers the survey and collects the responses each quarter. The survey has been administered quarterly since 2010.

>>Read Richmond Times-Dispatch coverage.

REQUEST RESULTS

The Council continues to expand the survey beyond its members, offering any area business owners whose companies gross at least $1 million in annual revenue the opportunity to participate. If enough businesses participate, the Council will provide survey results by industry. Participation is free, and all participants will receive copies of the survey data.

Business owners and CEOs who would like to participate in the next survey should contact Scot McRoberts at smcroberts@vaceos.org.

New Tariffs Having Less Impact on Virginia Companies than Expected; CEOs Concerned About Democratic Control of Congress

(Read Richmond Times-Dispatch coverage >)

Each quarter the Virginia Council of CEOs (VACEOs) and University of Richmond’s Robins School of Business partner to take the pulse of top executives in the region through a comprehensive Virginia CEO Economic Outlook Survey.

The third quarter 2018 CEO Economic Outlook survey by the University of Richmond’s Robins School of Business and the Virginia Council of CEOs finds that Virginia CEOs’ expectations for sales, capital spending, and employment over the next six months increased compared to their expectations last quarter. As a result, the survey’s index rose to its fourth-highest level ever, reversing declines of the past two quarters.

Repeating a question from last quarter, CEOs were asked about the expected impact of tariffs on their business. This quarter, 60 percent expect no impact, 31 percent expect a somewhat negative impact, and only nine percent expect a large negative impact. These results differ from those last quarter, indicating less impact of tariffs than expected last quarter, as portrayed in the table below.

| IMPACT OF TARIFFS: HISTORICAL DATA |

September 2018 |

June 2018 |

| Large positive impact |

0% |

0% |

| Somewhat positive impact |

0% |

3% |

| No impact |

60% |

41% |

| Somewhat negative impact |

31% |

49% |

| Large negative impact |

9% |

6% |

With the upcoming midterm elections, CEOs were asked how a Democratic takeover of Congress would impact the outlook for their business over the next 12 months. Twenty-four percent expect no impact, 21 percent expect a somewhat (13%) or large (8%) positive impact, while 55 percent expect a somewhat (32%) or large (23%) negative impact.

“The survey shows that CEOs are increasingly positive on the economy,” said Randy Raggio, Associate Dean at the Robins School of Business. “This is partly explained by reduced concern about the potential negative impact of tariffs.” Raggio administers the survey and collects the responses each quarter.

“Polarizing politics and tweetstorms from the top seem to have no negative effect on the outlook for small businesses in our area,” said Scot McRoberts, Executive Director of the Virginia Council of CEOs. Adding, “CEOs continue to struggle with workforce shortages but seem to be adapting to this reality.”

Economic Index Historical Data

| Year | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 |

|---|---|---|---|---|

| 2020 | -18.73 (historic low) | |||

| 2019 | 100.5 | 94.13 | 86.33 | 101.47 |

| 2018 | 94.60 | 92.73 | 104.30 | 97.97 |

| 2017 | 108.97 (historic high) | 103.63 | 99.17 | 106.3 |

| 2016 | 102.00 | 89.00 | 89.67 | 107.37 |

| 2015 | 93.90 | 93.42 | 99.80 | 92.67 |

| 2014 | 86.07 | 88.71 | 96.10 | 95.92 |

| 2013 | 86.40 | 91.60 | 92.53 | 89.57 |

| 2012 | 94.10 | 81.13 | 81.17 | 77.57 |

| 2011 | 85.63 | 74.17 | 81.17 | 88.63 |

| 2010 | 81.33 | 94.47 | 92.27 | |

EXECUTIVE SUMMARY

The 2018 third quarter survey found that seventy-nine percent of CEO respondents expect sales to increase over the next six months, up seven percentage points from the second quarter results. To summarize, CEOs predictions over the next six months include:

- 79 percent expect an increase in sales (up 7 points from last quarter)

- Nearly 42 percent of respondents expect capital spending to increase (up nearly 4 percentage points compared to last quarter)

- Nearly 57 percent expect employment to increase

- 62 CEOs responded to the survey, which was administered September 19 – 25

- Multiple industries are represented in the sample, including construction, manufacturing, finance and insurance and retail

- The average company revenue (most recent 12-month period): $13 million

- The average employment count: 44

READ COMPLETE ECONOMIC SURVEY RESULTS

The Robins School and VACEOs jointly conduct the quarterly survey, which regularly asks about expectations for sales, capital spending and employment, plus other relevant issues, helping Virginia companies anticipate business conditions and plan for growth. The Robins School adapted the survey from the Business Roundtable, an association of CEOs of American companies that conducts a similar survey nationally. Randy Raggio, associate dean at the Robins School, administers the survey and collects the responses each quarter. The survey has been administered quarterly since 2010.

Read Richmond Times-Dispatch coverage.

REQUEST RESULTS

The Council continues to expand the survey beyond its members, offering any area business owners whose companies gross at least $1 million in annual revenue the opportunity to participate. If enough businesses participate, the Council will provide survey results by industry. Participation is free, and all participants will receive copies of the survey data.

Business owners and CEOs who would like to participate in the next survey should contact Scot McRoberts at smcroberts@vaceos.org.

2018 Q2 Survey Finds New Tariff Expected to Have Limited Impact on Virginia Companies

Each quarter the Virginia Council of CEOs (VACEOs) and University of Richmond’s Robins School of Business partner to take the pulse of top executives in the region through a comprehensive Virginia CEO Economic Outlook Survey.

The second quarter 2018 CEO Economic Outlook survey by the University of Richmond’s Robins School of Business and the Virginia Council of CEOs finds that, compared to last quarter, Virginia CEOs’ expectations for sales increased, but expectations for capital spending fell.

The survey’s index, which measures executives’ views on projected hiring, capital spending and sales over the next six months, fell to its lowest level since Q3 2016, marking declines for four of the past five quarters.

Economic Index Historical Data

| Year | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 |

|---|---|---|---|---|

| 2020 | -18.73 (historic low) | |||

| 2019 | 100.5 | 94.13 | 86.33 | 101.47 |

| 2018 | 94.60 | 92.73 | 104.30 | 97.97 |

| 2017 | 108.97 (historic high) | 103.63 | 99.17 | 106.3 |

| 2016 | 102.00 | 89.00 | 89.67 | 107.37 |

| 2015 | 93.90 | 93.42 | 99.80 | 92.67 |

| 2014 | 86.07 | 88.71 | 96.10 | 95.92 |

| 2013 | 86.40 | 91.60 | 92.53 | 89.57 |

| 2012 | 94.10 | 81.13 | 81.17 | 77.57 |

| 2011 | 85.63 | 74.17 | 81.17 | 88.63 |

| 2010 | 81.33 | 94.47 | 92.27 | |

“The outlook among small business CEOs in central Virginia remains strong, but unemployment below 3.5% is limiting the ability of many of these businesses to scale,” said Scot McRoberts, executive director of the Virginia Council of CEOs.

“The survey shows that CEOs are generally positive on the economy,” said Randy Raggio, Associate Dean at the Robins School of Business. Raggio administers the survey and collects the responses each quarter. “The recent declines we have seen in the index reflect a shift from high growth to more stable growth. However, there is reason for concern related to tariffs.”

WILL NEW TARIFFS AFFECT BUSINESS?

This quarter, CEOs were asked about the expected impact of new tariffs. None expect a large positive impact; roughly three percent expect a somewhat positive impact. More than 49 percent expect a somewhat negative impact; more than six percent expect a large negative impact. More than 41 percent expect no impact.

EXECUTIVE SUMMARY

The 2018 second quarter survey found that executives’ expectations for sales to increase over the next six months. To summarize, CEOs predictions over the next six months include:

- Nearly 72 percent expect an increase in sales (up nearly four percentage points/last quarter)

- More than 37 percent of respondents expect capital spending to increase (down four percentage points/last quarter)

- 50 percent expect employment to increase

- 64 CEOs responded to the survey, which was administered June 26-July 3

- Multiple industries are represented in the sample, including construction, manufacturing, finance and insurance and retail

- The average company revenue (most recent 12-month period): $12 million

- The average employment count: 46

READ COMPLETE ECONOMIC SURVEY RESULTS

The Robins School and VACEOs jointly conduct the quarterly survey, which helps Virginia companies anticipate business conditions and plan for growth. The Robins School adapted the survey from the Business Roundtable, an association of CEOs of American companies that conducts a similar survey nationally. Randy Raggio, associate dean at the Robins School, administers the survey and collects the responses each quarter. The survey has been administered quarterly since 2010.

Read Richmond Times-Dispatch coverage >

REQUEST RESULTS

The Council continues to expand the survey beyond its members, offering any area business owners whose companies gross at least $1 million in annual revenue the opportunity to participate. If enough businesses participate, the Council will provide survey results by industry. Participation is free, and all participants will receive copies of the survey data.

Business owners and CEOs who would like to participate in the next survey should contact Scot McRoberts at smcroberts@vaceos.org.

Virginia Council of CEOs, Robins School of Business quarterly survey index falls on lower expectations for growth in sales and employment

Each quarter the Virginia Council of CEOs (VACEOs) and University of Richmond’s Robins School of Business partner to take the pulse of top executives in the region through a comprehensive “Economic Outlook Survey.”

The first quarter 2018 CEO Economic Outlook survey by the University of Richmond’s Robins School of Business and the Virginia Council of CEOs (VACEOs) finds that Virginia CEOs’ expectations for sales and employment fell from last quarter, while expectations for capital spending were unchanged.

The survey’s index, which measures executives’ views on projected hiring, capital spending and sales over the next six months, fell to its lowest level since Q3 2016.

Economic Index Historical Data

| Year | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 |

|---|---|---|---|---|

| 2020 | -18.73 (historic low) | |||

| 2019 | 100.5 | 94.13 | 86.33 | 101.47 |

| 2018 | 94.60 | 92.73 | 104.30 | 97.97 |

| 2017 | 108.97 (historic high) | 103.63 | 99.17 | 106.3 |

| 2016 | 102.00 | 89.00 | 89.67 | 107.37 |

| 2015 | 93.90 | 93.42 | 99.80 | 92.67 |

| 2014 | 86.07 | 88.71 | 96.10 | 95.92 |

| 2013 | 86.40 | 91.60 | 92.53 | 89.57 |

| 2012 | 94.10 | 81.13 | 81.17 | 77.57 |

| 2011 | 85.63 | 74.17 | 81.17 | 88.63 |

| 2010 | 81.33 | 94.47 | 92.27 | |

“There’s a lot to like in the local business environment. I think small business CEOs get a little nervous when things are so good, but this remains a fairly optimistic forecast,“ said Scot McRoberts, executive director of the Virginia Council of CEOs.

“After five of the best quarters in the survey’s history, it appears that expectations are leveling off,” said Randy Raggio, Associate Dean at the Robins School of Business. Raggio administers the survey and collects the responses each quarter. He adds, “Manufacturers and companies that sell to them report strength. But interest rates are a concern among residential and commercial developers, and small-scale retailing is weak.”

EXECUTIVE SUMMARY

The first quarter 2018 CEO Economic Outlook survey found that executives’ expectations for capital spending were significantly unchanged from last quarter. To summarize, CEOs predictions over the next six months include:

- More than 67 percent of CEO respondents expect sales to increase (down nearly 10 percentage points from last quarter)

- More than 41 percent of CEOs expect capital spending to increase (nearly identical to last quarter)

- More than 49 percent expect employment to increase (down from 62 percent last quarter)

- Over 45 percent expect employment to remain flat (up from about 38 percent last quarter)

- Sixty-one CEOs responded to the survey, which was administered March 28 – April 4, 2018

- Multiple industries are represented in the sample, construction, manufacturing, finance and insurance and retail

- The average company revenue (most recent 12-month period): $13.3 million

- The average employment count: 64

READ COMPLETE ECONOMIC SURVEY RESULTS

The survey, adapted from a similar Business Roundtable national survey, provides a snap shot of the overall economic outlook index for various companies within the region. It also helps central Virginia companies anticipate business decisions and plan for growth. Randy Raggio, Associate Dean at the Robins School of Business, administers the survey and collects the responses each quarter.

Read Richmond Times-Dispatch coverage here >

REQUEST RESULTS

The Council continues to expand the survey beyond its members, offering any area business owners whose companies gross at least $1 million in annual revenue the opportunity to participate. If enough businesses participate, the Council will provide survey results by industry. Participation is free, and all participants will receive copies of the survey data.

Business owners and CEOs who would like to participate in the next survey should contact Scot McRoberts at smcroberts@vaceos.org.

2017 Third Quarter Economic Survey Results

Each quarter the Virginia Council of CEOs (VACEOs) and University of Richmond’s Robins School of Business partner to take the pulse of top executives in the region through a comprehensive “Economic Outlook Survey.”

The third quarter 2017 CEO Economic Outlook survey finds that optimism among Virginia CEOs remains high, but falls from levels seen in the previous three quarters, which were the highest in the survey’s seven-year history.

Economic Index Historical Data

| Year | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 |

|---|---|---|---|---|

| 2020 | -18.73 (historic low) | |||

| 2019 | 100.5 | 94.13 | 86.33 | 101.47 |

| 2018 | 94.60 | 92.73 | 104.30 | 97.97 |

| 2017 | 108.97 (historic high) | 103.63 | 99.17 | 106.3 |

| 2016 | 102.00 | 89.00 | 89.67 | 107.37 |

| 2015 | 93.90 | 93.42 | 99.80 | 92.67 |

| 2014 | 86.07 | 88.71 | 96.10 | 95.92 |

| 2013 | 86.40 | 91.60 | 92.53 | 89.57 |

| 2012 | 94.10 | 81.13 | 81.17 | 77.57 |

| 2011 | 85.63 | 74.17 | 81.17 | 88.63 |

| 2010 | 81.33 | 94.47 | 92.27 | |

The survey’s index, which measures executives’ views on projected hiring, capital spending and sales over the next six months, was the sixth-highest ever. The three previous quarters (Q1 2017, Q4 2016, and Q2 2017), saw the index reach the highest marks in the survey’s history. The survey has been administered quarterly since 2010.

“Small business CEOs are thriving in this environment. It is fascinating to watch. Some are growing rapidly in order to capture market share or acquire competitors, while others are throttling growth to focus on higher profits,” said Scot McRoberts, executive director of the Virginia Council of CEOs. “The economy could move faster, but we can live with this for a while!”

“Despite a drop in the index, CEOs remain optimistic as more expect sales and hiring to increase over the next six months,” said Randy Raggio, Associate Dean at the Robins School of Business. Raggio administers the survey and collects the responses each quarter. He adds, “Although expectations for increased capital spending fell this quarter, they were high for the previous three, so companies seem to be catching up with higher sales and staffing.”

EXECUTIVE SUMMARY

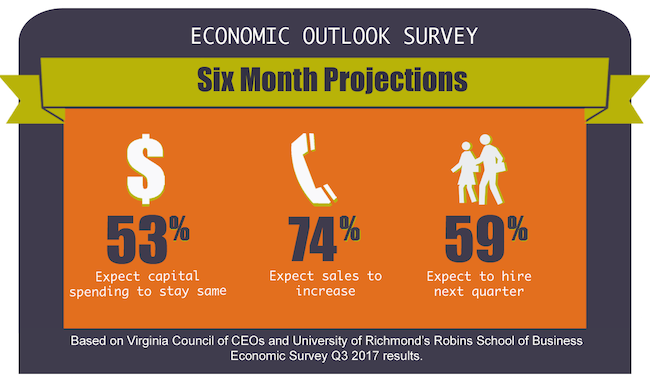

The 2017 third quarter survey found that executives’ expectations for sales and hiring increased slightly, while expected capital spending fell. To summarize, CEOs predictions over the next six months include:

- 74.4 percent expect an increase in sales (up from 73.4 percent last quarter)

- 52.6 percent of respondents expect capital spending to stay the same (compared to 53.1 percent last quarter)

- 59 percent expect employment to increase (compared to 56.3 percent last quarter)

- 78 CEOs responded to the survey, which was administered September 27 – October 3

- Multiple industries are represented in the sample, including construction, manufacturing, finance and insurance and retail

- The average company revenue (most recent 12-month period): $9 million

- The average employment count: 55

READ COMPLETE ECONOMIC SURVEY RESULTS

The survey, adapted from a similar Business Roundtable national survey, provides a snap shot of the overall economic outlook index for various companies within the region. It also helps central Virginia companies anticipate business decisions and plan for growth. Randy Raggio, Associate Dean at the Robins School of Business, administers the survey and collects the responses each quarter.

Read Richmond Times-Dispatch coverage >

Read Robins School of Business press release >

REQUEST RESULTS

The Council continues to expand the survey beyond its members, offering any area business owners whose companies gross at least $1 million in annual revenue the opportunity to participate. If enough businesses participate, the council will provide survey results by industry. Participation is free, and all participants will receive copies of the survey data.

Business owners and CEOs who would like to participate in the next survey should contact Scot McRoberts, executive director, Virginia Council of CEOs.

Recent Comments