Virginia Economic Outlook Index Continues to Rebound; 89% of Small Business CEOs Prefer the Fed to Hold or Reduce Interest Rates; 64% view AI as a Positive Capability

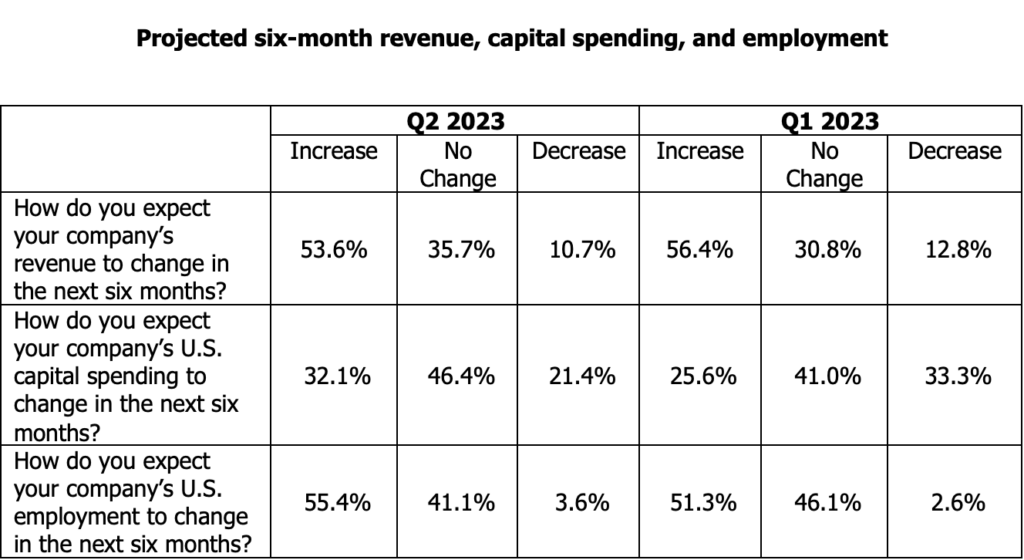

CEOs Again Expect Revenue and Employment to Increase Over Next 6 Months with Capital Spending Remaining Flat

UNIVERSITY OF RICHMOND ─ Eighty-nine percent of small business CEOs indicate that they prefer that the Fed either reduce interest rates or hold them at the current rate with 11% preferring that rates increase further. Sixty-four percent of respondents view Generative AI as a positive capability to be embraced with only 6% seeing AI as a danger to be avoided. That’s the latest from the quarterly CEO Economic Outlook Survey conducted by the University of Richmond’s Robins School of Business and the Virginia Council of CEOs.

Fifty-four percent of CEOs expect revenue to increase, with 18% expecting at least a 10% increase, while 55% expect employment to increase over the next six months.

The survey found expectations over the next six months for revenue and employment were both positive with employment to grow faster than expectations a quarter ago. Expectations with regard to capital spending remained primarily flat.

More than half (54%) of CEOs indicated that they expect revenue to increase over the next six months.

- 2% expected revenue to be “significantly higher.”

- 52% expected revenue to be “higher.”

- 11% expected revenue to be “lower.”

- 36% indicated they expected no change.

Thirty-two percent of CEOs expect capital spending to increase over the next six months (up slightly from last quarter), while 21% expect capital spending to decrease. More than 46% expect capital spending to remain flat.

Fifty-five percent of respondent CEOs expect employment to increase over the next six months. Additionally, 41% expect employment to remain flat while only 4% expect employment to fall.

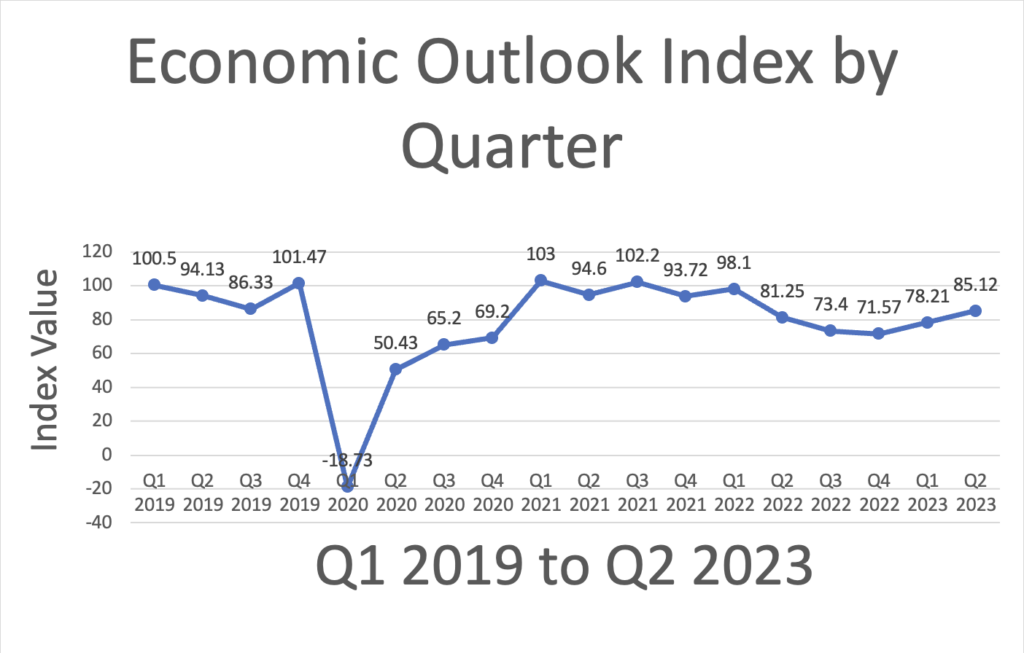

Taken as a whole, the results pertaining to revenue, capital spending, and employment continue the positive trend of last quarter with the overall Economic Outlook Index increasing (85.1 versus 78.2) relative to the results from the end of Q1 2023.

Additionally, CEOs were asked their preference with regard to further interest rate changes by the Fed. They reported that they preferred the following:

- Further raise rates: 11%

- Reduce rates: 40%

- Leave rates as they are: 49%

They were also asked their opinion on the potential impact of Generative Artificial Intelligence (AI) tools (such as ChatGPT) on their businesses. They reported that they viewed these tools as follows:

- A positive capability to be embraced: 64%

- A danger to be avoided: 6%

- No opinion at this time: 31%

“The survey results suggest that CEOs continue to see a positive future. They also strongly prefer that the Fed avoid further interest rate hikes” said Rich Boulger, associate dean at the Robins School, who administers the survey and collects the responses. “The overall index continues to rise (85.1 versus 78.2 at the end of Q1 2023 and slightly up from 81.3 of a year ago).”

“The sentiment from CEOs I am talking with lately is far more pessimistic than this data. The storm clouds they are seeing must be beyond the survey’s six-month outlook!” said Scot McRoberts, executive director of VACEOs.

The Robins School and VACEOs jointly conduct the quarterly survey, which regularly asks about expectations for revenue, capital spending, and employment, plus other relevant issues, helping Virginia companies anticipate business conditions and plan for growth. The Robins School adapted the survey from the Business Roundtable, an association of CEOs of American companies that conducts a similar survey nationally. Rich Boulger, associate dean at the Robins School, administers the survey and collects the responses. The quarterly survey has been administered since 2010.

Fifty-five CEOs responded to the survey, which was administered Julyl 11 – 17. Multiple industries are represented in the sample although services and construction represented the majority of the respondents. The average company whose CEO responded to this survey had approximately $10 million in revenue for the most recent 12-month period. The average employment was 55.

The Council continues to expand the survey beyond its members, offering any area business owners whose companies gross at least $1 million in annual revenue the opportunity to participate. If enough businesses participate, the Council will provide survey results by industry. Participation is free, and all participants will receive copies of the survey data.

Virginia Council of CEOs (VACEOs) is a nonprofit organization connecting CEOs for learning and growth. Formed more than 20 years ago, member benefits include placement in a peer roundtable group and access to a thought leader network, and a robust program of events for learning and growth. This is not a networking group, but rather a group of CEO peers who are invested in the success of each Member. To qualify for membership CEOs must run a business with $1M+ revenue and 5+FTEs. Learn more at www.vaceos.org.

The Robins School of Business is the only fully-accredited, highly-ranked undergraduate business school that also is part of a highly-ranked liberal arts university. The Robins School is also home to the Richmond MBA. The school’s executive education division offers customized training and consulting to a wide variety of businesses.

Leave a Reply