Virginia Economic Outlook Index Down Slightly in Q2 2021, Employers Hesitant to Require Vaccine

CEOs expect sales and employment to increase over the next six months with capital spending flat.

Each quarter the Virginia Council of CEOs (VACEOs) and University of Richmond’s Robins School of Business partner to take the pulse of top executives in the region through a comprehensive Virginia CEO Economic Outlook Survey.

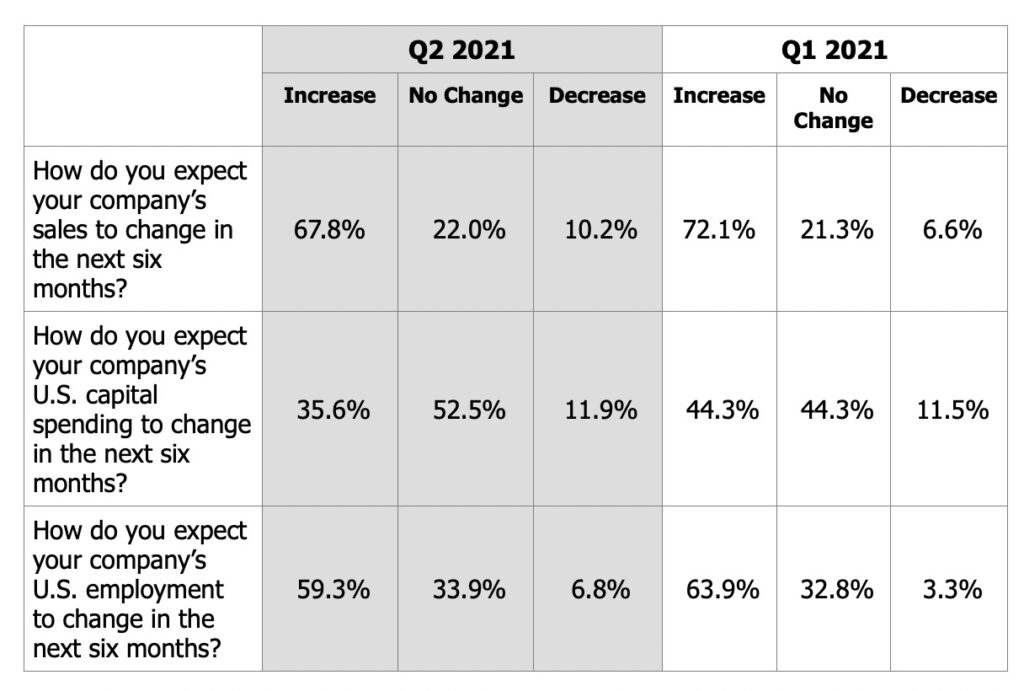

The second quarter 2021 CEO Economic Outlook survey finds that expectations over the next six months for sales and employment are positive with capital spending remaining flat compared with expectations at the end of Q1 2021.

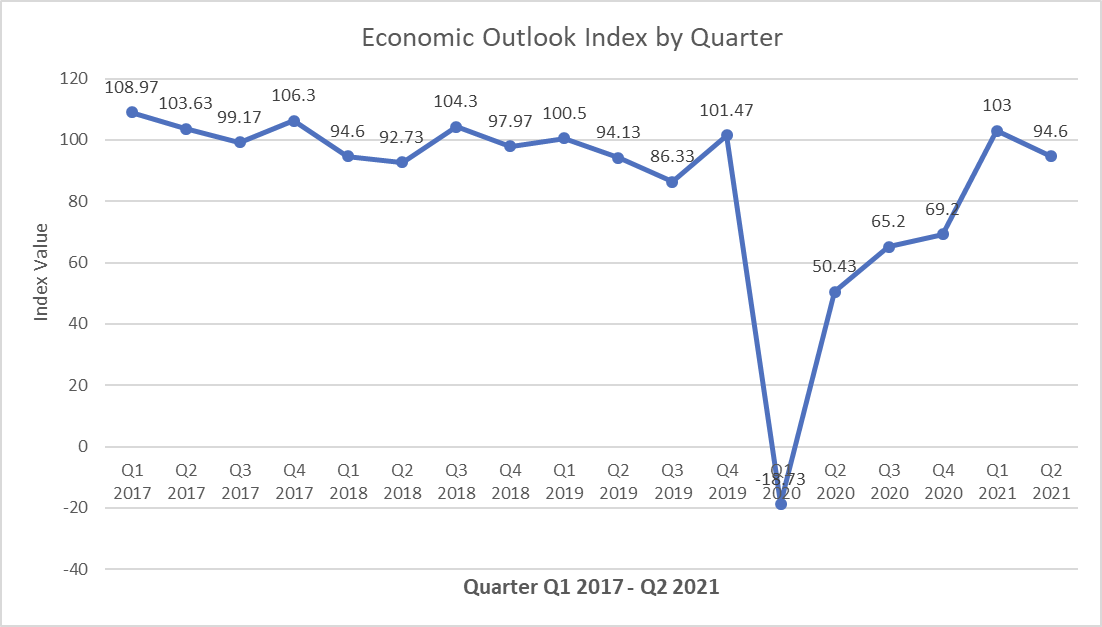

Taken as a whole, the results pertaining to sales, capital spending, and employment are still positive but produce a slight reduction in the economic outlook (94.6 versus 103.0) relative to the results from the end of Q1 2021.

Robins School of Business/VA Council of CEOs Economic Survey Historical Data

| YEAR | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2021 | 102.80 | 94.6 | ||

| 2020 | -18.73* | 50.43 | 65.20 | 69.20 |

| 2019 | 100.5 | 94.13 | 86.33 | 101.47 |

| 2018 | 94.60 | 92.73 | 104.30 | 97.97 |

| 2017 | 108.97* | 103.63 | 99.17 | 106.30 |

| 2016 | 102.00 | 89.00 | 89.67 | 107.37 |

| 2015 | 93.90 | 93.42 | 99.80 | 92.67 |

| 2014 | 86.07 | 88.71 | 96.10 | 95.92 |

| 2013 | 86.40 | 91.60 | 92.53 | 89.57 |

| 2012 | 94.10 | 81.13 | 81.17 | 77.57 |

| 2011 | 85.63 | 74.17 | 81.17 | 88.63 |

| 2010 | — | 81.33 | 94.47 | 92.27 |

| *historic high/low | ||||

Says Scot McRoberts, executive director of the Virginia Council of CEOs, “The remarkable thing to me in this survey is that 60% of the CEOs reported that their businesses were stronger than pre-pandemic. This syncs with the observation that the pandemic hit hardest in narrow verticals. The slight dip in the index may be related to recent news of a Covid surge, along with ongoing workforce shortages. I see continuing optimism among the small and mid-sized business CEOs with whom I work.”

“The survey results suggest that CEOs remain optimistic about the next six months, although they do not expect as much growth as they did a quarter ago. This is likely due to the fact that they have experienced significant growth over the last quarter and are basing growth projections on a higher base,” said Rich Boulger, associate dean at the Robins School.

CEOs WEIGH IN ON REQUIRING VACCINATIONS AND IMPACT ON PANDEMIC ON OVERALL BUSINESS IMPACT

In addition to the survey questions regarding sales, capital spending, and employment, the survey asked CEOs to express their plans, if any, with regard to requiring employees to be vaccinated for COVID-19 in order to work in person. Their response regarding required vaccinations was as follows:

- Yes (will require vaccination): 10%

- No (will NOT require vaccination): 63%

- Unclear at this time whether vaccination will be required: 27%

Additionally, CEOs were asked what the overall impact was on their business over the timeframe of the pandemic. Their response was as follows:

- The business is stronger than pre-pandemic: 60%

- The business is weaker than pre-pandemic: 16%

- The business is unchanged relative to pre-pandemic: 24%

EXECUTIVE SUMMARY: SALES, CAPITAL SPENDING, HIRING

To summarize, CEOs predictions over the next six months include:

SALES EXPECTATIONS

- 68 percent expect an increase in sales

- 7 percent expected sales to be “lower”

CAPITAL SPENDING EXPECTATIONS

- 36 percent of respondents expect capital spending to increase (compared to 44 percent last quarter)

- 12 percent expect capital spending to decrease

- 52 percent expect capital spending to remain flat

EMPLOYMENT EXPECTATIONS

- 59 precent expect employment to increase

- 7 percent expect employment to fall

- 34 percent expect employment to remain flat

SURVEY SAMPLE

- 59 CEOs responded to the survey, which was administered July 12 – July 16, 2021

- Multiple industries are represented in the sample although services and construction represented the majority of the respondents.

- The average company revenue (most recent 12-month period): $18 million

- The average employment count: 80

The following survey results from the first quarter of 2021 and the second quarter of 2021 show projections for the next six months for sales, capital spending, and employment.

- The average company revenue (most recent 12-month period): $18 million

- The average employment count: 80

The following survey results from the first quarter of 2021 and the second quarter of 2021 show projections for the next six months for sales, capital spending, and employment.

About the Economic Survey

The Robins School and VACEOs jointly conduct the quarterly survey, which regularly asks about expectations for sales, capital spending and employment, plus other relevant issues, helping Virginia companies anticipate business conditions and plan for growth.

The Robins School adapted the survey from the Business Roundtable, an association of CEOs of American companies that conducts a similar survey nationally. Rich Boulger, associate dean at the Robins School, administers the survey and collects the responses each quarter. The survey has been administered quarterly since 2010.

About Robins School of Business

The Robins School of Business is the only fully-accredited, highly-ranked undergraduate business school that also is part of a highly-ranked liberal arts university. U.S. News ranks the Robins School’s MBA program #2 in Virginia. The school’s executive education division offers customized training and consulting to a wide variety of businesses.

Leave a Reply