Follow the Leaders

Q&A with Lauren Sweeney, CEO of Dotted Line

Q: You are a native of Richmond and attended Randolph-Macon College. What is your favorite spot or activity in Richmond?

A: I love the river and some of the trails around Richmond, as I have recently gotten more into hiking. The close proximity to the mountains or beach also makes it easy to find things to do on the weekends. I believe Richmond is a great city to live in based on the market size – it’s easier to find a community and get around town than a larger city, and Richmond is large enough to offer a multitude of things to do.

Q: Who inspired you to become an entrepreneur?

A: I come from a family of small business owners. My grandfather owned a small oil and gas business in rural Virginia, and we were very close. Growing up, I saw and heard firsthand the power and impact of this engine of the economy. I also have an entrepreneurial spirit and love figuring out how to build new things.

Q: Please tell us about your journey to become a CEO.

A: My path was influenced by a combination of large corporate experience and early exposure to small business ownership. My first job out of college was at a Richmond-based Fortune 200 company, where I learned broader business knowledge and how important investments in learning and development are to building leaders. The first business I started was an e-commerce company that sold paper planners. As I evaluated my next move, I had a series of conversations with small business owners that revealed marketing challenges specific to their businesses. This was the genesis for Dotted Line. I started the agency in 2014, and we had our strongest year ever in 2021.

Q: What excites you most about your role as CEO?

A: I’ve learned that Dotted Line’s potential rests on the strength of its people. Growing our team members and leaders is one of my most important jobs as the CEO. At Dotted Line, we focus on developing leaders that our agency will need not only today, but five years from now. We also are at a transformational moment, as the agency just debuted on the Inc. 5000 list of the nation’s fastest-growing private companies. Our momentum and growth are continuing in 2022.

Q: How are you promoting leadership development at Dotted Line?

A: We make a significant investment in our people. For 2022, we launched a year-long Leadership Development program that’s designed to build confident, team-based leaders. This investment – which is rare for both a marketing firm and for an organization of our size – ensures that team members have the shared skills and background to grow into future roles with Dotted Line and beyond. The program is open to everyone at the agency, not just those in existing management roles, because I believe everyone needs fundamental leadership skills – like influencing and having difficult conversations – to be effective in their jobs. We also dedicate a percentage of our budget to coaching, skills-based learning and mentoring opportunities.

Q: Are there any national/business authors that you follow? What is it about them or their message that resonates with you?

A: I’m a big fan of Dave Ramsey. His book and coaching program EntreLeadership has been an exceptional resource for me as a small business owner. Dave focuses on how to be a great leader and grow a successful small business. I have participated in many of his conferences and coaching events over the years.

I am also a big fan of Jesse Itzler, a serial entrepreneur. Jesse leads with high levels of passion and excellence and believes that the more you experience in life, the more you have to give. Jesse encourages people to have one big, impossible goal each year. This is something that stretches you and has a lasting effect on you all year. This year, I’m participating in an ultra-endurance event called 29029 Everesting. We have 36 hours to reach 29029 feet – the equivalent height of Mt. Everest. It’s quite the challenge, and I am looking forward to experiencing something this transformational.

Q: You are very involved in the community, including the National Association of Women Business Owners and being on the board of directors for the Virginia Chamber of Commerce. How has your work with these organizations impacted you as a CEO?

A: Meeting, learning from, and networking other leaders has been formative to me as a business owner and CEO. As a young entrepreneur, I’m learning and leading at the same time. Outside guidance and expertise has been essential.

Q: You joined VACEOs in the height of the pandemic in 2020, what part of your membership has helped you grow the most as a leader?

A: I have loved getting to know and having the support of my roundtable members. Many of our businesses are similar in size, and we have similar aspirational goals. I am learning from them, and the support as a small business owner has been incredibly helpful.

Know the Risks so you can Reap the Rewards of your Company’s Retirement Plan

A guest post by Tripp Leonard, CFP ®, AIF ®, CEPA®, Partner at Irongate Capital Advisors, a VACEOs sponsor

A company’s retirement plan is more than just ‘table-stakes’ to attract & retain talented people. Well designed & closely monitored, a corporate retirement plan will ‘connect’ to the company’s culture, empower your workforce, and provide the owners with a tax-efficient tool to reward & incentivize growth.

A qualified retirement plan can also serve as a tax-efficient mechanism to support an owner’s exit or internal equity transition to key managers.

Qualified Retirement plans can seem complicated and come with significant fiduciary responsibility. Three (of many) key considerations:

1. Know exactly what you are paying for administrative expenses and how these costs are retrieved

- With more than 170 ERISA class action lawsuits filed in federal court the past couple of years1, 401k plan sponsors (the owners of the business) need to understand their fiduciary responsibility with respect to their company retirement plan.

- The main trouble-spot is revenue-sharing within the expense ratios of the plan’s investment line-up. The expense ratio a participant sees per investment is not always what is paid to the management team selecting their stocks or bonds within the fund. There may be sub-TA or 12b-1 revenue that is paid to other parties. This leads to administrative expenses increasing as the plan assets grow – and the potential for one participant to contribute more to plan expenses than another based on the fund selected.

- Tibble v. Edison & Tussey v. ABB – two often-cited and important legal cases that are important for plan sponsors to understand – highlight the importance of a prudent process, transparency with respect to plan administration expenses, and share class selection.

- As Charlie Munger once said – “All I want to know is where I’m going to die, so that I’ll never go there.” Understand where the trouble spots lie with respect to fees, expenses, and regulatory precedent – reviewed, monitored, and benchmarked annually – and you will be an advocate for your workforce and create a tailwind for compounding their wealth.

2. Conflicts of Interest

- Depending on the recordkeeper you select for your company’s retirement plan, it is important to understand the various layers of economic incentives.

- For example, administrative pricing may be impacted by the target-date series you select for the plan. The target-date-series is often the Qualified Default Investment Account (QDIA). Be careful here. Ideally, as a decision maker, you do not want ‘constraints’ when it comes to selecting plan investments for your workforce.

- Stable Value v. Money Market Funds is another ‘category’ leading to multiple lawsuits against employers. Anthem had a class-action suit brought against their plan – one issue being the offering of Vanguard’s Prime Money Market instead of a Stable Value Fund. Stable Value Funds often have higher yields than money market funds with similar ‘stability’ of principal at the participant level.

- Not all Stable Value Funds are created equal – and often the recordkeeper selected may ‘encourage’ your stable value fund selection. You have options.

- Proactive understanding of various conflicts of interest will help guide decision making that benefits your plan and your team.

3. New Comparability Profit Sharing Formula and/or Cash Balance Plans

- Many 401k or corporate retirement plans include a company match. This may be done as a safe-harbor match or a discretionary match – creating an incentive for participants to save and an opportunity for the company, using cash flow from the business, to accelerate their pace of savings.

- The actual profit-sharing sleeve of the 401k retirement plan is often ignored. This sleeve allows a business to evaluate at year-end whether there is a portion of corporate earnings-before-taxes that should be directed to the retirement plan. These contributions are tax-deductible, not imputed as income to the participants, and often include a vesting schedule that provides a retention component.

- The default profit-sharing formula for most plan documents is ‘pro-rata.’ For closely held companies, changing that formula to ‘new comparability’ allows the flexibility to allocate profit sharing contributions to select or tiered groups. Your administrator has specific compliance guidelines that drive the allocation formulas; however, the flexibility will often surprise you.

- For example, you may want to emphasize rewarding the ownership/management team first, then project managers next, then superintendents, etc. There are multiple factors including ages, incomes, structure of any safe-harbor contributions; however, the flexibility of a new-comparability profit sharing formula justifies having iterations run so you know what is possible. A well-designed profit-sharing plan can provide a very tax-efficient executive benefit that has an ‘equity’ feel for your workforce.

- Lastly, cash-balance plans are a relatively flexible version of a defined benefit plan. For businesses with consistent, predictable cash flow, a well-designed cash balance plan can be the ‘4th leg’ to the qualified retirement plan (deferrals, match, profit sharing, cash balance) that allows owners (and key people) to receive large, tax-deductible retirement plan contributions on top of 401K Profit Sharing deposits. For example, the 2022 maximum contribution to a 401k profit sharing plan (if age 50+) is $67,500. A cash balance deposit for this individual can be as high as $343,000 in 2022 for a total contribution limit of $410,500. There is ample flexibility below these max-levels, but you get the point – potential for very high current year tax-deductions and the potential for a tax-efficient planning tool to prepare an owner for retirement, exit, or simply diversification.

As a decision maker, a well-designed and well monitored retirement plan involves looking at the right information in the right way and doing what is best for participants and their beneficiaries. The financial health of your workforce will benefit from your time, energy, and process. And with the right design, your company’s retirement plan can also be a highly effective capital allocation tool for the owners & management team.

1Bloomberg Law 4.5.22

About Tripp Leonard CFP ®, AIF ®, CEPA®

Tripp.Leonard@irongate-capital.com

Tripp Leonard is an equity partner of Irongate Capital Advisors. Since 1994, he has worked with private businesses, their owners, and their key people in the areas of business succession planning, capital allocation & investment management, risk management, and employee benefits. His practice is focused on fee-based corporate & personal financial planning and investment advisory services for individuals, corporations, and qualified retirement plans.

Financial Professionals do not provide specific tax/legal advice and this information should not be considered as such. You should always consult your tax/legal advisor regarding your own specific tax/legal situation.

Tripp Leonard is a Registered Representative and Investment Advisor Representative of Securian Financial Services Inc. Securities and Investment Advisory services offered through Securian Financial Services Inc. member FINRA/SIPC. Irongate Capital Advisors is independently owned and operated. 800 E Canal St. Suite 950, Richmond, VA 23225. TR: 4834629 DOFU: 07/2022

VACEOs Fall Leaders Conference 2022

This is a new event you won’t want to miss! We encourage business owners/CEOs to bring their executive teams. VACEOs Members and Sponsors will get a discounted rate but register now to receive the best rates.

Join VACEOs on September 19, 2022, at the Jefferson Hotel in Richmond, Virginia, to spend the day with Verne Harnish – scaleup expert, world renown speaker and bestselling author.

Verne’s Scaling Up presentation focuses on the Four Decisions methodology that every company must get right: People, Strategy, Execution and Cash. Verne will be sharing fours specific ideas-one each for People, Strategy, Execution and Cash-that you can use immediately to drive a positive impact in the business. Look at the #1 most important question to ask in each of the four decisions-and practical examples of how various small to mid-market firms answered these questions, driving much better results.

In the end it’s about getting more money, saving more time, and having more fun in scaling up your business. Verne Harnish will help you get there. To register, click HERE.

Sponsorship Opportunities

Sponsorship opportunities are available. Please contact Scot McRoberts to learn more.

Topics Verne will cover in Scaling Up include:

PEOPLE: Recruitment, on boarding, coaching & culture:

Designing the employee journey.

STRATEGY: Purpose, core customer, brand promise & identifying the company culture.

EXECUTION: Systems, processes & accountability through current technologies.

CASH: Cash flow, margins, key performance indicators & efficiencies.

To register now, click HERE.

Schedule for the day:

Monday, September 19

8:30 AM – 9:00 AM: Registration

9:00 AM – 12:30 PM: Verne Harnish (People & Strategy)

12:30 PM – 1:30 PM: Lunch

1:30 PM – 5:00 PM: Verne Harnish (Execution & Cash)

5:00 PM – 6:00 PM: Cocktail Reception

Who is this for:

This program is open to all CEOs and their senior executive teams. Click HERE to register.

About the Speaker

Verne Harnish is founder of Entrepreneurs‘ Organization and Scaling Up, a global coaching and executive education firm. He has spent the past four decades helping companies scale. He‘s author of Mastering the Rockefeller Habits; The Greatest Business Decisions of All Time; Scaling Up (Rockefeller Habits 2.0) and Scaling Up Compensation.

Future-Proofing Your Career in 2022: Break The Bias

VACEOs partners with Robins MBA to #breakthebias

In recognition of International Women’s Day, over 100 women gathered at the University of Richmond on March 10 to hear a keynote address by Susan Quinn, President & Chief Executive Officer of circle S studio for the fourth annual Future-Proofing Your Career event. Her topic: Break the Bias which is also this year’s International Women’s Day theme.

Hosted jointly by the Virginia Council of CEOS (VACEOs) and The Richmond MBA, the festivities took place at the Jepson Alumni Center to a sold-out crowd of women from all different stages of their careers.

An executive with 30 plus years of experience, Susan believes that “leadership is a mindset from the inside out.” It needs to be cultivated and nurtured like a garden and “not left to chance.”

Speaking for 30 minutes to an attentive audience, she mapped out four keys to future-proofing one’s career. They include:

- Respect yourself and stop apologizing

- Keep an open mind and stay curious

- Be authentic – don’t try to be anyone but yourself

- Raise the bar – keep bettering your personal best

Following Susan’s keynote address, there was a panel discussion of business leaders, including Virginia Council of CEOs (VACEOs) member Connie Hom, CEO of Buckingham Greenery, Inc., Melody Short, co-founder of The Jackson Ward Collective and Polly White, Chair of the ChamberRVA and COO of Gather.

For Connie Hom, a first time panelist, but a four time Future-Proofing Your Career attendee, she shared that loved all of the energy in the room and was grateful for the opportunity to get together in person this year to “learn, improve and grow.”

Jennifer Boyden, CEO of Heart Havens, Inc., said “Being among and having conversations with other professional women is empowering. It is encouraging to see how far we have come and motivating to see how far we still need to go to work in a bias-free world.”

The words “inspirational” and “powerful” could be heard being murmured all around the cocktail reception held towards the end of the evening.

Susan Quinn best summed it up when she said there was “a lot of power packed into that room.” She also said, “when women come together to learn something new, they are often successful and there is no limit to what they can accomplish.”

About The Richmond MBA

The Richmond MBA is a highly-ranked part-time program designed to meet the needs of working professionals. With small class sizes and experienced, engaged faculty, the student body is comprised of high-potential individuals who form a network of ambitious and innovative leaders driving change across central Virginia’s top organizations. The program is part of the larger Robins School of Business, a fully-accredited business school in a liberal arts university, recognized nationally for quality and excellence.

About Virginia Council of CEOs (VACEOs)

Virginia Council of CEOs (VACEOs) is a nonprofit organization connecting CEOs for learning and growth. Formed more than 20 years ago, member benefits include placement in a peer roundtable group and access to a thought leader network, and a robust program of events for learning and growth. This is not a networking group, but rather a group of CEO peers who are invested in the success of each member. To qualify for membership CEOs must run a business with $1M+ revenue and 5+FTEs. Learn more at www.vaceos.org.

Tips To Take Your Heart Health to the Next Level

How to Improve Your Heart Health

“What can I do to improve my heart health?”

It’s one of the questions we get asked most frequently at PartnerMD, and not just every February during American Heart Month. For good reason, heart health is (and should be) a year-round focus.

In a general sense, the answer isn’t all that difficult. Just about every habit – good or bad – can effect your cardiovascular health. The three main healthy habits you should focus on should not be a surprise.

Top Three Healthy Habits

Eat healthy foods. More than two-thirds of heart disease-related deaths worldwide can be linked to food choices, according to a recent study in the European Heart Journal.

Exercise regularly. Sedentary people have a 35% greater risk of developing high blood pressure than physically active people do, per the University of Maryland Medical Center. High blood pressure is a leading cause of heart disease.

Make an active effort to sleep better. A recent study published in the Journal of the American College of Cardiology found that people sleeping fewer than six hours per night had a 20% higher chance of a heart attack.

If you can make progress in those three core areas, you’re going to improve your heart health. But what if the question is slightly different?

“What can I do to really take my heart health to the next level?”

That’s quite a different question, because it’s really about supercharging how you eat, exercise, and sleep. That likely means investing in products that are on the cutting edge of those core health areas.

If you’re looking to take your heart health habits to the next level, here are four products that could help.

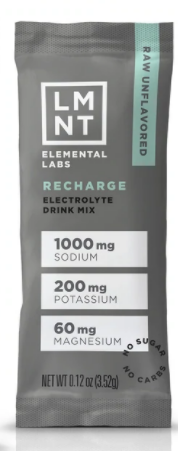

1. LMNT Electrolyte Supplements

Electrolytes help regulate your fluids, produce energy, and strengthen your bones. You lose electrolytes by removing processed foods from your diet (i.e. low carb/keto), because processed foods are often high in sodium (an electrolyte), and through things like sweat (i.e. exercising).

So, if you follow a low carb/keto diet or exercise intensely, you can become electrolyte deficient. You can be eating well and exercising regularly – both very beneficial heart health habits – but still feel off. You may even suffer from headache, muscle cramps, etc., which lead you to abandon those healthy habits.

Gatorade and Powerade are well-known for their electrolytes, but they also contain high amounts of sugar. Sugar leads to inflammation throughout the body, which can ultimately lead to heart disease. One study published by JAMA Internal Medicine found people who eat a high-sugar diet had a 38% higher risk of dying from heart disease.

LMNT electrolyte supplements are sugar-free and stevia-sweetened and “formulated to help anyone with their electrolyte needs.” They’ll help you maintain your electrolyte levels and operate at peak performance more often than not. A 12-pack starts at $20.

2. Red Light Therapy Device

Red light therapy uses low-wavelength red light to supply your cell mitochondria with extra energy to boost new cell growth.

It has been shown to have many positive health effects, such as improved collagen production, wound healing, and muscle recovery; reduced inflammation; decreased pain; and improved mental acuity.

In particular, recent studies have shown that red light therapy could assist exercise performance and recovery, two very helpful things for heart health.

A study in the American Journal of Physical Medicine and Rehabilitation found that “light therapy also promotes the growth of healthy muscle tissue, or muscle hypertrophy, naturally increasing muscle size and bulk—as well as strength.”

Red light therapy devices allow you to bring red light therapy to your home. They essentially replicate the light your body gets from natural sunlight without the heat or UV rays. JOOVV is one of the top brands in this space, but they are pricey at more than $500.

3. Calm or Headspace (Sleep and Meditation Apps)

With long hours and plenty of competition, it’s no secret that stress and sleep are among the biggest health concerns of CEOs. Stress is also a very common risk factor when it comes to heart disease. At the most basic level, stress triggers inflammation, which can ultimately lead to heart disease.

However, stress and sleep problems often affect the rest of your healthy habits. Your nutritious diet might go out the window with a little bit of stress eating and a lack of sleep. And we all know it’s next to impossible to find the will to exercise when we’re tired.

But like just about everything these days, there is an app for that. Calm and Headspace are two of the most popular ones. They both produce guided meditations to help you manage your stress and provide sleep soundtracks and breathing exercises to help you sleep better. Not sure which to choose? Here is an article comparing both options.

Both are free to download and offer limited free features but cost $69.99 per month for an annual subscription and access to their full complement of features. We all already spend enough time on our phones. With these apps, you can use some of that time to improve your health.

4. Oura ring

Let’s assume you’re doing all these things. You’re living a largely healthy lifestyle. Now you need someway to track your progress. Something that gives you the ability to know when you’re improving, when you’re sustaining, and when you might need to re-focus.

While an Apple Watch or Fitbit is a useful tool for fitness tracking worn on your wrist, an Oura ring is worn as a ring on one of your fingers.

It analyzes your sleep, your activity levels, and how ready you are to take on the day. It can also track your heart rate, your body’s recovery rate. It even gives you a “readiness score” every day and recommends an activity level based on your recent data. They start at around $300.

And one more tip: Find your partner in health.

We’d be remiss if we didn’t mention another thing that can help take your heart health to the next level – a high-quality, personal relationship with your healthcare team. That team includes your primary care doctor and maybe even a health coach.

As a concierge medicine practice, we provide both to our patients. You get personalized care for a physician who has the time to guide your healthy lifestyle and access to on-staff certified health coaches who can help formulate a plan and hold you accountable to it. In fact, all these products were recommended by one of our health coaches. Learn more about membership at PartnerMD here.

About Virginia Council of CEOs (VACEOs)

Virginia Council of CEOs (VACEOs) is a nonprofit organization connecting CEOs for learning and growth. Formed more than 20 years ago, member benefits include placement in a peer roundtable group and access to a thought leader network, and a robust program of events for learning and growth. This is not a networking group, but rather a group of CEO peers who are invested in the success of each member. To qualify for membership CEOs must run a business with $1M+ revenue and 5+FTEs. Learn more at www.vaceos.org.

Recent Comments